Exclusion Undermines Volunteers

|

Midwesterners, like citizens all over the nation, enjoy firework displays. For some, the level of pleasure derived from such events motivates their effort to involve themselves more fully than being spectators. This month’s In Action revolves around a volunteer situation that worked out quite poorly.

Two persons volunteering at two different fireworks events were injured. Specifically, they suffered burns when fireworks, distributed by the same company, prematurely exploded. Both parties sought damages from the distributor and after the claim was made to and denied by the insurer, suits were filed.

The situation hinged on the status of volunteers during firework displays. The plaintiffs galvanized their efforts in battling the wording of a particular exclusion. Their arguments alleged that the exclusion barred coverage for any type of volunteers who participate in public firework activities.

The plaintiffs were consistent in arguing that the exclusion wording was confusing to the point that coverage should apply. In the end, two levels of courts disagreed with their position. They ruled that the language clearly prevented coverage for a broad class of persons, including those who volunteered their services to their events.

Please click on the link to get more details on the court case.

|

| |

The Purpose: Avoid Unwanted Exposures

|

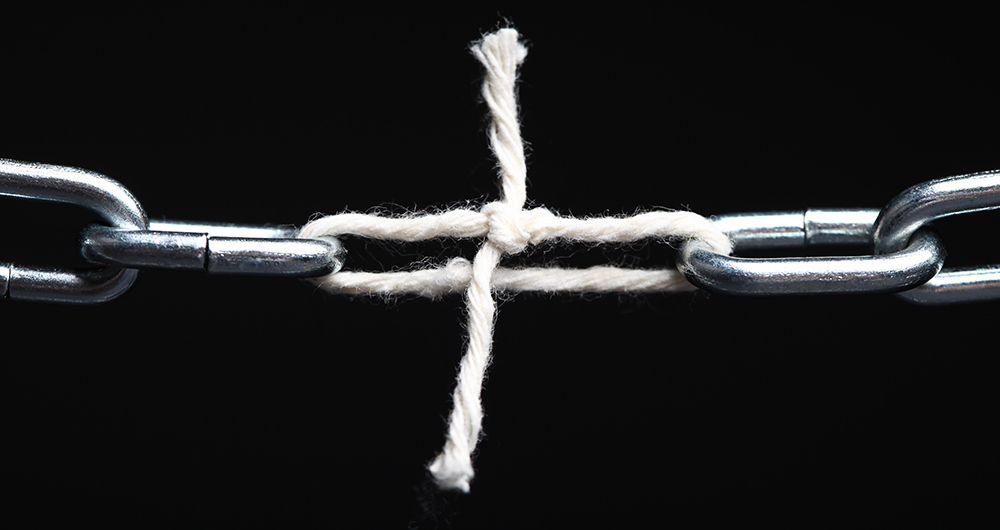

It can be unfortunate when, after a loss, an insured or claimant discovers that insurance protection is not available to make them whole. But that is often the reality. A given insurance policy is defined by its design. The design consists not only of coverages and limitations, but exclusions as well. The latter is critical for insurance to perform and remain viable. Premiums that are not matched to policy parameters have little chance to provide insurers with revenue that allows them to meet their coverage and operational objectives.

Insurance policies routinely exclude sources of loss that fall outside of policy design. Exclusions help make a given policy affordable and allows matching between lines of insurance and their related risks. Ironically, they can also expand insurance availability. If an insurer can maintain more control over the type of losses they have to respond to, they have a greater ability to operate on a long-term basis as there is greater predictably over their expected losses. Policyholders, on the other hand, are better able to secure protection with insurance programs that handle loss exposures that are most likely to threaten their existence.

Click here to see information about types of losses that are typically barred from coverage. It is from Gordis on Insurance found in Advantage Plus.

|

| |

The Importance of Identifying Exposures

|

Identification and understanding the exposures that a business faces is always insanely important! These factors certainly may have been at the heart of the above dispute. Could such a loss situation arise if all parties had complete knowledge and been engaged in clear communication? Though we can only guess about the underlying facts, it’s quite likely that exposure identification and communication were both sub-par.

Securing any form of coverage is incomplete if policyholders are uncertain of their protection. Therefore, providing coverage should never be formed around assumptions. There are many instances, both personal and commercial, that include risks that could be overlooked by base (unmodified) policies. It’s prudent to take steps to ferret out and, if possible, address them.

Click here to see an article that discusses a tool to assist in determining possible sources of loss. It is from PF&M, found in Advantage Plus.

|

| |

Accountability Is Critical

|

The fireworks distributor routinely supplied a class of, well, explosives to various customers for use at public events. It purchased liability coverage, so what was the reason for a coverage gap? From the insurer’s standpoint, the gap was intended. When writing the coverage for the fireworks distributor, it insisted on modifying the policy with an endorsement that barred coverage for those involved in setting off fireworks and related activities. The problem was that the other parties to the contract argued that they were unaware or confused over the crucial coverage limitation, specifically involving volunteers.

Eventually, two levels of litigation resulted in a definitive decision regarding coverage. However, where was the needed communication? Where was the culpability? The entire point of insurance, when viable, is to deal with possible losses. Its use is diminished when not properly applied. Accountability should exist in all coverage transactions. A party that recognizes what is at stake and who is willing to take responsibility to mitigate problems is essential!

Click here to see an article that discusses accountability. It is from the March 2021 issue of Rough Notes Magazine found in Advantage Plus.

|

| |

|

|

|