PERSONAL UMBRELLAS - BUSINESS ACTIVITY AND NEGLIGENT ENTRUSTMENT

Umbrella policies are extensions of primary insurance in more ways than one. Besides extending protection, such policies also extend exclusions, seeking to avoid the same sources of loss as those barred by underlying policies. Two problem areas are business activity and negligent entrustment.

Business Activity

Generally, personal umbrella liability insurance does not apply to business activities. A high percentage of coverage questions, uncertainties and disputes with respect to this insurance involve work-related matters. An insurance professional who recommends umbrella coverage can avoid problems by explaining that such policies apply solely to personal activities.

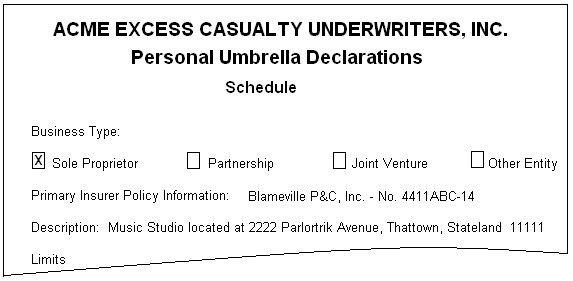

Of course, there are always exceptions, such as a loss involving business activity, incidental to the home, for which coverage is provided by underlying personal insurance. The underlying insurance’s business activity would have to be listed on the umbrella’s declarations page.

On the other hand, some jurisdictions can vary in how a business-related loss is treated, especially if an exclusion is deemed to be a technicality.

Personal umbrella liability insurance is applicable to volunteer, non-remunerative work in church, school, civic and service organizations. Again, any coverage may depend upon the contractual relationship between the underlying and the excess coverage. For instance, latter editions of standard homeowner policies now apply a more concise definition of business activity. While this situation may make the HO position clearer, it could also create a gray area under the umbrella.

Rather than guess about coverage, it makes far more sense to identify such exposures and provide specific coverage. Insurance companies commonly permit coverage to be added via endorsement. However, such coverage must also appear on the underlying coverage level.