(July, 2013)

Exclusions

Part D - Coverage for Damage to Your Auto will not pay for:

1. Loss to an owned or non-owned auto that occurs while it is used for hire to transport persons or goods. An exception is made for car pools, where the driver gets money for only gas and wear and tear.

2. Damage resulting from your car's aging, extremely cold weather, mechanical or electrical breakdown, or road damage.

|

|

Example: It took Pete two hours to start his car during a typical winter's morning in North Dakota. After it starts, he jumps in the car and the engine dies. He has it towed to Fargo's best garage and the mechanic tells him that the car is toast. Pete used a cheap engine oil that broke down due to EXTREME cold, and the engine wasn't lubricated. As much as we might feel for Pete, this is not a covered loss under the PAP.

|

An exception is made for such damage that is related to the total theft of a covered auto (owned or non-owned).

|

Example: Pete gets a new car and is leaving a restaurant to get his car from his parking space when he notices that a stranger is breaking into his car. The thief sees Pete, quickly hot-wires the car, and drives out of the lot. The thief is in such a hurry that she doesn't bother to avoid a loose sewer cover while escaping. The police discover the car the next day with the interior stripped of electronics. The front end, including the tires, is severely damaged. Normally, the destroyed tires would be excluded, but since it happened during a theft, Pete's settlement would include reimbursement for the tire damage.

|

3. There's no coverage for any loss caused by radioactive contamination, nuclear weapons, war, insurrection, rebellion or revolution.

|

Example: Alan Newtron is coming home from work and he rear-ends a panel truck from a hospital that just started operating in his area. He is puzzled when, as he gets out to trade insurance information, the doors of the truck are flung open. Screaming, the truck's driver and two passengers jump out and run from the truck. Alan also wonders why they were wearing protective suits. Alan's curiosity is satisfied when he peers into the truck and notices that a new X-ray machine is laying in the back...cracked into two pieces. Any damage caused by the ongoing irradiation is excluded from coverage.

|

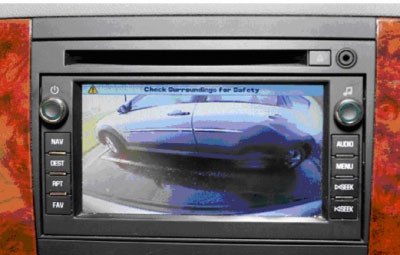

4. Part D of the PAP does not cover loss to electronic equipment designed for reproducing, receiving or transmitting signals (both audio and visual). For instance, the PAP begins by excluding coverage for equipment such as radios, tape decks, stereos or compact disc players. Other items that are becoming common auto components are also barred from coverage such as navigation devices, phones, computers, TVs, scanners and similar equipment. However, there are some exceptions. There IS coverage for equipment IF the equipment is permanently installed in your covered auto or any non-owned auto.

Note: Another issue that may need to be addressed, although the items that are listed in the PAP is just illustrative, the fact that it includes obsolete devices and fails to mention newer devices could still create claim disputes.

5. This exclusion is for any media that is used with such equipment as well as any accessories used with equipment that reproduces sound, receives or transmits (audio and/or visual) signals.

|

|

|

A rearview camera, permanently mounted, is a newer type of accessory that qualifies for coverage under the PAP.

|

6. No coverage is available for vehicles listed on the policy or those that qualify as a non-owned auto when they are destroyed or taken by military or civil authorities.

|

Example: Marnie's car is confiscated by the local police when illegal drugs are found to have been hidden in the vehicle. This loss is ineligible for coverage under Marnie's PAP

|

Of course, an exception is made for the financial interests of loss payees. It isn't in the public interest to deny protection to lenders because of the illegal acts of their borrowers.

7. There's no coverage for a camper body, motor home or trailer owned by an insured, but not listed on the declarations page. Neither is there any coverage for awnings, cabanas (lightweight structures with living facilities) and equipment designed to create additional living facilities including cooking, refrigerating or plumbing equipment. Coverage for such property should be endorsed to the policy using PP 03 07–Trailer/Camper Body Coverage (Maximum Limit of Liability). Of course, in many instances it would make more sense to purchase a special motor home or RV policy to properly protect rolling homes.

Related Article: Personal Auto Policy Endorsements

Are there any exceptions? Yes. This exclusion doesn't affect coverage for trailers (including their facilities or equipment) that are NOT owned by an insured.

|

|

Example: Sarah Grizzled was a poor, but avid, backpacker. While she usually just liked to camp with a tent, a friend convinced her to borrow his camper trailer for an excursion out West. Sarah was initially skeptical but, after a week's use, came to truly enjoy the trailer. Sarah was as upset as her friend when, while cresting a narrow, twisting mountain road, a quick maneuver caused the trailer to swing into the mountainside, obliterating it. This loss would be eligible for coverage under the PAP.

|

The PAP also provides coverage for trailers (including their facilities or equipment) that are newly acquired by the insured and which are reported to the insurer within 14 days. The intent of the policy is to make sure that all exposures are reported and rated.

|

Example: A retired couple buys a travel trailer without reporting it to their insurance company. Two weeks later, they take off on an extended vacation, a cross-country trip. Just as they're entering the third week of travel, the trailer detaches from the hitch while heading toward Pike's Peak. The trailer is destroyed. Unfortunately, the trailer is also uninsured, since it wasn't reported in time.

|

Of course, coverage would also apply to such equipment that the insured already owns on the date that the property is reported and coverage requested by the insured. However, most companies have their own additional restrictions in order to protect themselves against insureds who try to save money by requesting coverage while a trailer is being used (such as the summer) and then removing coverage while the property is in storage.

8. Any insured, including a family member, who has a loss involving a non-owned auto will find him without coverage if he doesn't believe he has permission to use that auto.

Related Court Case: Insurer Must Cover Non-Owned Auto Loss

9. Any equipment used to detect or locate radar or lasers aren't protected if it is lost or damaged.

10. All custom furnishings and equipment are excluded from coverage. Examples of such items are carpeting, insulation, furniture or bars, ovens, microwaves, beds/couches, roof extensions, murals, paintings, etc. These items should be separately endorsed since their value is rarely included in the vehicle value used to rate the basic physical damage coverage. ISO provides a special endorsement where these items can be listed and rated (PP 03 18–Customizing Equipment Coverage).

Related Article: Personal Auto Policy Endorsements

Is there an exception to exclusion 10? Yes. The exclusion is not extended to a pickup truck's cap, cover or bed liner. However, an insured MUST be the owner of the pickup that is equipped with this property.

11. This eliminates coverage for any non-owned auto that is being held or used by any insured while working at selling, repairing, servicing, storing or parking cars. The exclusion specifically mentions that it applies even during road testing and delivery. HOWEVER, this exclusion just applies to vehicles that are made for use on public highways.

It looks like exclusion 11 bars coverage for any auto-related business.

12. There is no coverage for any auto used in a speed contest or race. It clarifies the intent of the PAP by making the exclusion broad. There's no coverage for any auto that's located in a structure built to host auto races, including practices if the auto is there to actually participate in the contest.

Of course, your car should be safe if it's in the parking lot of a NASCAR track...at least we hope so. Actually the change to the PAP is logical to fulfill the policy's intent to avoid coverage for race-related exposures; including such times that a vehicle is at a location as a precursor to a participating in a race.

|

Example: An insured has a mint condition Yugo that's been modified for racing. (Hey, we didn't say it was a smart insured.) Anyway, the turbo Yugo is sitting in a racetrack garage just prior to a race when a nervous track visitor knocks over some fuel that splashes onto some hot equipment, starting a fire. Tragically, the Yugo is consumed. More tragic, this loss wouldn't be covered.

|

The PAP definitely means to distance itself from covering cars that have anything to do with organized racing. Persons who have these exposures have to look for special coverage, since ISO does not fill the coverage gap with any endorsement.

13. This item excludes any loss to a non-owned auto (including loss of use) rented by an insured when any applicable state law or rental agreement prohibits a rental car company from collecting for any loss or loss of use. In other words, the PAP won't provide protection when either state law or a rental contract provides that coverage must be part of the rental transaction. Such a legal requirement makes coverage under a PAP unnecessary.

|

|

Example: Karen Sufistakatid and her fiancée are on vacation and Karen has suggested spending a week traveling in the bordering western state. Although Karen's late model car is covered by a PAP, she prefers to rent a car since she doesn't want to affect the mileage use of her leasing agreement. Before renting the car she asks her insurance agent if she should get coverage for the rental. The agent says, "I guess so, but I think your policy covers rentals." Karen then calls a local car rental company. A rental clerk says that she can use her auto policy as coverage but must sign a special agreement to allow her credit card to be automatically billed for any losses to a rental including a daily charge for lost car rental income. Karen is relieved when she finds that the state she is vacationing in requires all rental companies to provide full coverage for ANY loss to a rental car for only a few dollars a day.

|