(July, 2014)

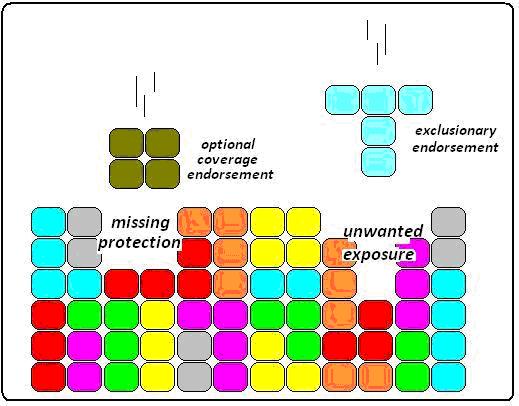

This article briefly discusses the common coverage options

available for modifying ISO’s basic homeowner policies. Where applicable,

you’ll find a reference to additional articles that discuss a particular

endorsement in greater detail.

Related Article: ISO Homeowners Optional Coverage

Endorsements Checklist

ANALYSIS OF OPTIONAL ENDORSEMENTS

The following are brief descriptions of the coverage for

ISO’s optional homeowner program endorsements that generally have countrywide

application:

HO 00 22–Transition

Endorsement

(Use only with HO 00 02)

This form can be used by companies to implement the 2011

changes without having to issue a new policy. It can only be attached to a ’00

edition policy. It is a bridge between the ’00 and ’11 editions of this HO base

form.

HO 00 23–Transition

Endorsement

(Use only with HO 00 03)

This form can be used by companies to implement the 2011

changes without having to issue a new policy. It can only be attached to a ’00

edition policy. It is a bridge between the ’00 and ’11 editions of this HO base

form.

HO 00 24–Transition

Endorsement

(Use only with HO 00 04)

This form can be used by companies to implement the 2011

changes without having to issue a new policy. It can only be attached to a ’00

edition policy. It is a bridge between the ’00 and ’11 editions of this HO base

form.

HO 00 25–Transition

Endorsement

(Use only with HO 00 05)

This form can be used by companies to implement the 2011

changes without having to issue a new policy. It can only be attached to a ’00

edition policy. It is a bridge between the ’00 and ’11 editions of this HO base

form.

HO 00 26–Transition

Endorsement

(Use only with HO 00 06)

This form can be used by companies to implement the 2011

changes without having to issue a new policy. It can only be attached to a ’00

edition policy. It is a bridge between the ’00 and ’11 editions of this HO base

form.

HO 00 28–Transition

Endorsement

(Use only with HO 00 08)

This form can be used by companies to implement the 2011

changes without having to issue a new policy. It can only be attached to a ’00

edition policy. It is a bridge between the ’00 and ’11 editions of this HO base

form.

HO 03 12–Windstorm or Hail Percentage Deductible

(All Forms Except HO 00 04 and HO 00 06)

This form allows a special deductible to be applied to any

loss to insured property that results from powerful winds or from hail. The

form's deductible is a stated percentage of the limit of insurance that appears

for Coverage A–Dwelling. Even though the deductible is determined by

multiplying the Coverage A-Dwelling limit, the deductible applies to any wind or hail loss that occurs under any

Section I (property) coverage(Coverage A, B, C or D).

HO 03 18–Hurricane

Deductible

This form allows a special deductible to be applied to any

hurricane loss to insured property. The form’s deductible is a stated

percentage of the limit of insurance for Coverage A-Dwelling and is applied to

the total of all loss (Coverages A, B, C or D) from a single hurricane. The

definition of what constitutes a hurricane is part of the form.

HO 04 10–Additional

Interests–Residence Premises

This simple form merely allows one or more parties who have

an insurable interest in the insured home to be added to the homeowner policy.

Besides identifying other additional interests, it also obligates the insurer

to give the listed parties advance notice if and when the homeowner policy

coverage is to be terminated.

HO 04 11–Additional

Limits Of Liability for Coverages A, B, C, and D

Depending upon the insured agreeing to fully insure the

covered buildings at the amount recommended (calculated) by the insurer, the

covered property is protected at its full replacement cost. The policy will pay

for replacement, even when the cost exceeds the limit shown on the policy.

Replacement cost is provided by amending the basic policy’s Loss Settlement

provision. This form refers to buildings in place of dwellings so that its

intent to be applied beyond Coverage A is clarified. If a building is

constructed at a different location, the insurer is only obligated to pay an

amount no greater than if the rebuilding took place on the original insured

location.

HO 04 12–Increased

Limits on Business Property

Related Article: HO 04 12–Increased Limits On

Business Property

HO 04 13–Sections I and

II Exclusions for Computer-Related Damage or Injury

This form limits the additional coverages granted to an

insured for permitted businesses that are operated on the insured premises. When

a “business” endorsement has been added to a policy to cover businesses such as

offices, studios, day care or farming operations, the HO 04 13 acts to exclude

any computer hardware or software loss that is related to that business.

Specifically, the endorsement bars coverage for any bodily injury or property

damage caused by a computer, accessories, peripherals or similar equipment,

which fails due to programming or similar malfunctions. However, the form still

permits coverage for “bodily injury” that either occurs on the residence

premises or away from the residence as long as the “bodily injury” occurs at

the premises where the insured’s described business is located.

HO 04 14–Special

Computer Coverage

(All Forms Except HO 00 05, HO 00 04 with HO 05 24, and HO

00 06 with HO 17 31.)

Related Article: HO 04 14–Special Computer Coverage

HO 04 15–Section II–Limited

Coverage for Year 2000 Computer Related and Other Electronic Problems

This form nullifies the liability exclusion created by the

HO 04 13–Sections I And II Exclusions For Computer-Related Damage or Injury

endorsement. The endorsement ONLY covers computer failure caused by an

inability to process, interpret or handle specific dates such as the year 2000.

However, this coverage exception applies only to the “business” activity

described in the policy that is modified by the HO 04 15.

HO 04 16–Premises

Alarm or Fire Protection System

This form recognizes that one or more protective systems

exist on the insured premises and that the insurer has provided a premium

credit for the system(s). The form requires the insured to keep the equipment

in working order and to tell the insurer of any changes, including the removal

of any equipment. Coverage for a given loss may be denied if the applicable equipment

is not present and in working order.

HO 04 18–Deferred

Premium Payment

This form allows an insured the option to pay the policy

premium in installments that are identified on the declarations. The annual

premium amounts are based upon the rates in effect at the time the installment

is due.

HO 04 20–Specified

Additional Amount of Insurance for Coverage A–Dwelling

(Used with Forms HO 00 02, HO 00 03 and HO 00 05)

This form provides an automatic increase in protection under

Coverage A. The increase is a percent of the Coverage A

insurance limit that is specified either on the form or elsewhere in the

policy. This is an especially useful endorsement when the insured is making

improvements or adding on to the building and a loss occurs before the insured has

had the chance to notify the insurer. This form’s coverage applies similarly to

endorsement HO 04 11–Additional Limits of

Liability for Coverages A, B, C, and D.

Note: If an

insured has concerns about preserving full replacement cost for his building (structural)

assets, it would appear more logical to purchase the HO 04 11 form instead.

HO 04 26–Limited Fungi, Wet or Dry Rot, or Bacteria Coverage

(Used with all forms except HO 00 03 AND HO 00 05)

This form gives and takes away coverage. It adds a new

fungi, wet and dry rot or bacteria exclusion to Section I and then provides a

specific sublimit amount of coverage under the form’s Additional Coverages

Section I. It then introduces a sublimit that applies to coverage available

under Coverages E. and F.

HO 04 27–Limited Fungi, Wet or Dry Rot, or Bacteria Coverage

(Used with forms HO 00 03 AND HO 00 05)

Similar to HO 04 26 form (see above), but used for forms HO

00 03 and HO 00 05.

HO 04 28–Limited Fungi, Wet or Dry Rot, or Bacteria Coverage

(Used with forms HO 00 04 AND HO 00 06)

Similar to HO 04 26 form (see above), but used for forms HO

00 04 (modified by HO 05 24–see below) and HO 00 06 (modified by HO 17 31 or HO

17 32) –see below).

HO 04 30–Theft

Coverage Increase

(HO 00 08 Only)

This endorsement permits increases in the theft limit of

$1,000 on the HO 00 08 policy. This endorsement also can add theft coverage,

subject to a set limit, for theft of property away from the premises. However,

off-premises theft can only be bought after purchasing additional on-premises

coverage. Further, the Coverage C, Special Limits of Liability, which limits

the amount of recovery for theft of firearms, jewelry, watches, furs and

expensive stones and precious metal dinnerware, also applies when this coverage

is attached to a homeowners policy.

Related Article: ISO Homeowners Modified Coverage

Form HO 00 08

HO 04 35–Supplemental

Loss Assessment Coverage

This endorsement expands the loss assessment coverage

available in the base policy. The form increases the insurance limit for

assessments related to the described premises. The form is also extended to

cover condominium units other than the residence premises. Loss assessments

related to earthquake damage are not covered. The limit shown in the

endorsement (or elsewhere) is the TOTAL amount that could be paid for all

assessments that are the result of a single occurrence.

HO 04 36–Loss

Assessment Coverage for Earthquake

This endorsement covers an assessment due to earthquake

loss. This source of loss is not covered by the base policy nor

by HO 04 35–Loss Assessment Coverage. An insured is reimbursed for loss

assessments made as a result of loss caused by earthquake, including land shock

waves or tremors before, during or after a volcanic eruption. Units other than

the residence premises can be covered. A single deductible applies to all

assessments arising from one occurrence. The deductible is whichever is lower:

$500 or the amount equal to the selected percentage of the selected limit of

insurance.

The form excludes coverage for assessments charged to an

individual, corporation or a property-owner association, by a municipality or

other government unit.

HO 04 40–Structures

Rented to Others (Residence Premises)

This endorsement provides coverage for structures other than

the residence that are located on the described premises, rented or held for

rental to others. Coverage applies only when such structures are used for

residential purposes and are not occupied by more than two families or more

than two roomers or boarders per family. Provision is made in the endorsement

for as many as three structures held for rental. Each structure is insured with

its own limit of insurance. The coverage applies only to structures which are

either currently occupied by renters or are being held out for rental. Either

the entire structures or just a portion of the structures may be rented out and

the purpose of the rental MUST be for use as a residence.

HO 04 41–Additional

Insured (Residence Premises)

This endorsement extends a homeowners policy, without

additional premium charge, to cover the interest of a non-occupant joint owner

in the building and for premises liability. Only liability losses directly

connected to the building are eligible for coverage. However, no coverage is provided

for injury to an insured’s employees (including residence employees and their

replacements) who are hurt during the course of their employment duties. The

additional interest also receives advanced notice if the policy is to be

canceled or not to be renewed.

HO 04 42–Permitted

Incidental Occupancies (Residence Premises)

This endorsement may be used to cover incidental business

activity performed by an insured on the residence premises. The activity may

take place either in the insured dwelling or in an "other" structure

such as a detached garage or utility building. The endorsement also changes the

homeowners policy provisions so that coverage exists

for personal property associated with the activity. If the activity takes place

in an “other” structure, the endorsement provides protection that is specific

to the structure (the Coverage B insurance limit will not respond to losses to

the described “other” structure). Finally, the form expands the policy coverage

to provide protection against the legal liability related to the incidental

business. The full Coverage C limit applies to property of the business that is

described in the endorsement.

HO 04 43–Replacement

Cost Loss Settlement for Certain Non-Building Structures On the Residence

Premises

This form permits replacement cost settlement for certain

structural property such as exterior masonry, driveways, fences (made of metal,

plastic resin or fiberglass), walks and patios that are made of non-wood

materials. Swimming pools, therapeutic bath and hot tubs are also covered

whether or not they are in ground or semi-in ground. Coverage is subject to the

policy deductible and payment under this form reduces the total amount of

coverage available either under Coverage B or under coverage that is specific

to the applicable structure.

HO 04 46–Inflation

Guard

Related Article: HO 04 46–Inflation Guard

Endorsement

HO 04 48–Other

Structures on the Residence Premises

This endorsement provides an additional amount of insurance

on a specific “other” structure located on the residence premises. Several

structures may be identified in the endorsement, with a specific amount of

insurance applicable to each as an additional limit of insurance.

HO 04 49–Building

Additions and Alterations (Other Residence)

This endorsement may be used to cover additions, alterations

and improvements made at the insured's expense, to that part of a building that

is rented to the insured as a residence. The location and limit of liability

are specified on the form’s schedule.

HO 04 50–Increased

Amount of Insurance for Personal Property at Other Residences

This endorsement is used to increase the basic limit of

insurance under Coverage C–Personal Property that applies to personal property while

located at another residence owned by an insured (normally 10% of Coverage C).

The location of each such residence and the increased limit applicable to it

are specified in the endorsement.

HO 04 51–Building

Additions and Alterations–Increased LImit

(Used only with HO 00 04)

This endorsement gives an insured the option to increase the

coverage for building additions and alterations at the additional premium

developed from the Premium Section of the Homeowners Manual.

Related Article: ISO Homeowners 4 Contents Broad

Form Coverage Form Analysis

HO 04 52–Livestock

Collision Coverage

This endorsement is designed for hobby farmers. $400 is the

maximum payable for one head of livestock. No deductible applies to this

protection. The policy endorsement handles either a loss caused by a collision

with a vehicle during the transportation of the animal or damage suffered by

livestock that is struck after wandering onto a public road. Animals eligible

for coverage are cattle, sheep, swine, goats, horses, mules and donkeys. The

form excludes coverage for livestock struck by a vehicle that is operated by an

insured or an employee of an insured.

HO 04 53–Credit Card,

Electronic Fund Transfer Card, or Access Device Forgery and Counterfeit Money

Coverage–Increased Limit

This endorsement increases the limit of liability for such

property and occurrences to the optional specified limit. While Federal law

limits the financial risk faced by the loss or theft of a credit card, it has

not eliminated the need for the total coverage provided by the HO 04 53.

In the age of e-commerce, credit card related losses have

surged and check forgery has maintained its status as a steady loss exposure.

Coverage is provided for loss by forgery or alteration of any personal checks

or similar written instruments made or drawn by or upon an insured’s accounts.

This coverage also protects the insured for losses caused by his or her

acceptance, in good faith, of counterfeit United States or Canadian paper

currency. Finally, protection is included for losses arising from the

unauthorized use of electronic fund transfer cards and electronic fund access

devices.

HO 04 54–Earthquake

Related Article: HO 04 54–Earthquake Endorsement

HO 04 55–Identity

Fraud Expense Coverage

This endorsement assists with the cost of re-establishing

one’s credit history and record after being victimized by identity fraud.

Related Article: Identity Fraud

Expense Coverage.

HO 04 56–Special Loss

Settlement

(Used with forms HO 00 02, HO 00 03 and HO 00 05)

This endorsement is useful for covering older dwellings

having a market value that is less than their replacement cost.

Related Article: HO 04 56–Special Loss Settlement

HO 04 58–Other

Members of Your Household

This form permits a

person who is neither a spouse, relative or legal minor of a named insured to

be added (via schedule) as an insured when that person resides in the insured

household. It is intended for a person who is a full-time resident rather than

a guest, tenant, roomer, boarder or employee. Further, persons under the age of

21 who live with the scheduled party also attain status as insured household

members.

HO 04 59–Assisted

Living Care Coverage

This endorsement

allows the homeowner policy’s coverage to be extended to a scheduled legal

relative who is living

in an assisted living facility. In addition to the name of the person and the

facility description, limits for personal property and liability (Coverages C

and F) must be provided. Only those limits appearing in the form apply to a

given loss. Also, the form has some limited Additional Living Expense coverage

as well as a separate set of property sub-limits for certain types of property

that are vulnerable to loss such as eyeglasses, hearing aids, canes, walkers

and similar items.

HO 04 60–Scheduled

Personal Property Endorsement (With Agreed Value Loss Settlement)

This form expands the coverage under a homeowners

policy to apply to classes of personal property on a scheduled basis and on a

special form (as opposed to named peril) basis. Specific coverage limits may be

selected for up to nine classes of property (jewelry, furs, postage stamps,

coins, cameras, musical instruments, silverware, golf equipment and fine arts)

with an option of specific coverage for individual items.

Coverage applies on an agreed amount basis and is not

subject to a deductible.

Related Article: Personal Articles

Floater.

HO 04 61–Scheduled

Personal Property Endorsement

This endorsement may be attached to a homeowners

policy to provide coverage for scheduled personal property on a special form

cause of loss (as opposed to a named peril) basis. The coverage is subject to

certain exceptions and to individual company guidelines.

Related Articles:

Personal Articles Floater.

HO 04 61–ISO Scheduled Personal Property

Endorsement

HO 04 62–Scheduled

Personal Property

This endorsement is literally the first page of the HO 04 61

Endorsement that contains the schedule and can be used to change limits.

HO 04 65–Coverage C

Increased Special Limits of Liability

(Used with all forms except HO 00 05, HO 00 04 plus HO 05

24, or HO 00 06 plus HO 17 31.)

This endorsement may be used to increase the special limits

of liability provided under the homeowners forms for jewelry, watches and furs;

money and securities; silverware, gold ware and pewter ware; guns and portable

electronics. The increased limit of liability and the total limit of liability

may be shown either on the endorsement or elsewhere for each class of property

for which an insured wishes additional protection.

HO 04 66–Coverage C Increased

Special Limits of Liability Endorsement

(Used with HO 00 05, HO 00 04 plus HO 05 24, or HO 00 06

plus HO 17 31.)

The form increases limits for the same groupings as the HO

04 65 but for coverage as described in the HO 00 05, HO 00 04 plus HO 05 24, or

HO 00 06 plus HO 17 31. HO 04 77–Ordinance

or Law Increased Amount of Coverage

This endorsement applies to Additional Coverage 11.under

most forms but to building additions and alterations under HO 00 04 and

Additional Coverage 10. under HO 00 06. It increases

coverage for ordinance of law from 10% to whatever limit is entered in the

schedule. Loss is settled on the basis of any ordinance or law regulating the

construction, repair or demolition of a covered structure.

HO 04 78–Multiple

Company Insurance

Related Article: HO 04 78–Multiple Company

Insurance

HO 04 81–Actual Cash

Value Loss Settlement

This option converts the loss settlement provision of a

basic policy to pay losses on an actual cash value basis, UNLESS it costs less

to repair or replace the damaged property.

HO 04 85–Fire

Department Clause (Subscription Contract Services)

This endorsement is really an added policy condition and not

a coverage. It requires an insured to actively

subscribe to a service that provides fire-fighting services to the insured

property while the homeowners policy is in force.

HO 04 90–Personal

Property Replacement Cost

This endorsement changes the loss settlement basis under

Coverage C from actual cash value to full replacement cost.

Related Article:

HO O4 90–Personal Property Replacement Cost

HO 04 91–Coverage B–Other

Structures Away from the Residence Premises

(Used with HO 00 02, HO 00 03 and HO 00 05)

This endorsement extends the policy’s protection under

Coverage B for other, related structures that are located away from the

"residence premises." For example, it would provide coverage for a

barn located on land that is owned by an insured but is separated from that

insured’s "residence premises" by land owned by another party. There

is no coverage for a building that houses any sort of business activity

including storing business property.

HO 04 92–Specific

Structures Away from the Residence Premises

This endorsement is similar to HO 04 91, but this

endorsement establishes a separate limit of insurance for the structure, rather

than including the coverage in the existing Coverage B limit. The form

clarifies that there is no coverage for a building that houses any sort of

business activity including storing business property.

HO 04 93–Actual Cash

Value Loss Settlement Windstorm or Hail Losses to Roof Surfacing

(Used with all forms except HO 00 04)

This form converts the loss settlement provision to an

actual cash value (ACV) basis when the forces of winds or hail cause direct

damage to a roof’s surface materials.

HO 04 94–Windstorm or Hail Exclusion

(Used with HO 00 03 and HO 00 05)

This endorsement bars coverage for damage caused by winds

(including hurricanes) or hail. The exclusion does not apply to Coverage D loss

of use.

HO 04 95–Limited Water

Backup and Sump Discharge or Overflow Coverage

Related Article: HO O4 95–Limited Water

Back Up and Sump Discharge or Overflow

HO 04 96–No Section II – Liability Coverages For Home Day Care

Business Limited Section I – Property Coverages For Home

Day Care Business

This form excludes liability for loss

involving day care activity that, per the policy, is defined as a business.

However, it does provide up to $2,500 and up to $500 for on premises and

off-premises business property, respectively.

HO 04 97–Home Day

Care Coverage Endorsement

This endorsement provides modest property

coverage as well as day care liability protection.

Related Article: HO 04 97–ISO

Home Day Care Coverage Endorsement

HO 04 98–Refrigerated

Property Coverage

This endorsement provides limited coverage for property on

the "residence premises" that is stored in freezers or refrigerators

for damage from interruption of electrical service or mechanical failure of the

unit.

Related Article: HO 04 98–ISO Refrigerated

Property Coverage

HO 04 99–Sinkhole

Collapse

This endorsement provides coverage for direct loss caused by

sinkhole collapse, and renders the basic policy exclusion of earth movement

inapplicable to such an occurrence. Sinkhole collapse is physical damage

suffered when underground action of water on limestone or similar rock strata

causes the actual collapse or settlement of the earth supporting the damaged

property.

HO 05 24–Special

Personal Property Coverage

(Used with HO 00 04 Only)

This form changes the perils covered from named perils to

direct physical loss to property except as excluded.

HO 05 27–Additional

Insured–Student Living Away From the Residence Premises

This amends both major sections of the HO contract to

recognize the person described in the schedule as an insured. The form requires

the insured person with address be listed along with the name of the school

being attended. That person is an insured only if prior to school residency, he

or she was either a relative or a member of the base policy insured’s household.

HO 05 28–Owned

Motorized Golf Cart Physical Loss Coverage

This amends a HO contract to provide a limited and scheduled

amount of physical damage protection to golf carts owned by an insured. It

applies to non-modified carts that are incapable of exceeding 25 mph and that

are designed to travel on a golf course carrying no more than four persons. A deductible of $500 applies.HO 05 30–Functional Replacement Cost Loss Settlement

(Used with HO 00 02, HO 00 03 or HO 00 05)

This endorsement permits a lower limit of insurance because

instead of settling losses on a replacement cost basic each loss is based on

the cost to repair or replace the damaged property with a functional

equivalent. This applies to only Coverage A (Dwelling) and Coverage B (Other

Structures).

HO 05 31–Modified

Functional Replacement Cost Loss Settlement

(Used with HO 00 02 and HO 00 03 only)

This endorsement is identical to HO 05 30 above except that when the actual cash value basis is higher than

the functional replacement cost; the actual cash value settlement will be paid.

HO 05

41–Extended Theft Coverage for Residence Premises Occasionally Rented To

Others

This endorsement adds protection for theft losses that take

place in an insured home that an owner, every now and then, rents out to third

parties. However, the loss must occur in the area of the residence that has

been rented out.

No coverage applies when the loss involves various classes

of property such as money and similar property, securities and similar property

and jewelry and similar property.

HO 05 46–Landlord's Furnishings

(Used with HO 00 02, HO 00 03 and HO 00 05)

This endorsement increases the policy’s coverage for

property of a landlord that is located in an area occupied by a tenant. The

coverage is for the property specifically described in the form and for the

described limits. The amounts in the form are in addition to what is provided

by the base policy.

HO 05 80–Property

Remediation for Escaped Liquid Fuel and Limited Lead and Escaped Liquid Fuel

Liability Coverages

(Used with all forms except HO 00 04 and HO 00 06)

Related Article: HO 05 80–Property Remediation for

Escaped Liquid Fuel and Limited Lead and Escaped Liquid Fuel Liability

Coverages

HO 05 81–Property

Remediation for Escaped Liquid Fuel and Limited Lead and Escaped Liquid Fuel

Liability Coverages

(Used for HO 00 04 only)

This endorsement provides limited property and liability

protection against losses caused by exposure to lead and by liquid fuel that

escapes from its intended receptacle. This endorsement also extends coverage

for loss assessments made against the insured for damages arising from lead

exposure or escaped liquid fuel.

HO 05 82–Property

Remediation for Escaped Liquid Fuel and Limited Lead and Escaped Liquid Fuel

Liability Coverages

(Used for Form HO 00 06 Only)

This endorsement provides limited property and liability

protection against losses caused by exposure to lead and by liquid fuel that

escapes from its intended receptacle. This endorsement also extends coverage

for loss assessments made against the insured for damages arising from lead

exposure or escaped liquid fuel.

HO 05 83-Rating Information For Property

Remediation For Escaped Liquid Fuel & Limited Lead & Escaped Liquid

Fuel Liability

Explains how the premium was determined for a given policy’s

applicable limited coverage provided for remediation of escaped fuel and

liability involving lead exposure and escaped fuel.

HO 05 84-Property Remediation For Escaped Liquid

Fuel & Limited Lead & Escaped Liquid Fuel Liability Coverages

(Used with all forms except HO 00 04 and HO 00 06)

This endorsement provides limited property and liability

protection against losses caused by exposure to lead and by liquid fuel that

escapes from its intended receptacle. This endorsement also extends coverage

for loss assessments made against the insured for damages arising from lead

exposure or escaped liquid fuel.

HO 05 85-Property Remediation For Escaped Liquid

Fuel & Limited Lead & Escaped Liquid Fuel Liability Coverages

(Used for HO 00 04 only)

This endorsement provides limited property and liability

protection against losses caused by exposure to lead and by liquid fuel that

escapes from its intended receptacle. This endorsement also extends coverage

for loss assessments made against the insured for damages arising from lead

exposure or escaped liquid fuel.

HO 05 86-Property Remediation For Escaped Liquid

Fuel & Limited Lead & Escaped Liquid Fuel Liability Coverages

(Used for Form HO 00 06 Only)

This endorsement provides limited property and liability

protection against losses caused by exposure to lead and by liquid fuel that

escapes from its intended receptacle. This endorsement also extends coverage

for loss assessments made against the insured for damages arising from lead

exposure or escaped liquid fuel.

HO 06 07–Limited

Coverage for Theft of Personal Property Located In A Dwelling Under Construction

This form provides limited coverage for personal property

(as well as building materials and supplies) that is stolen from a building

that is being built. The coverage period begins at the starting date scheduled

on the form. The coverage (under the form) ends when construction is completed

and the building is occupied or on the ending date appearing on the form

(whichever occurs first).

HO 06 14–Increased

Amount of Insurance for Personal Property Located In A

Self-Storage Facility

This form changes the limit for items in a self-storage

facility from 10% of the Coverage C. limit or$1,000 whichever is less to

whatever limit is entered on the endorsement schedule. There are no other

changes in the coverage.

HO 06 15–Trust

Endorsement

Modifies HO coverage to extend protection

to homes owned under a trust agreement.

Related Article: HO 06 15–Trust Endorsement

HO 06 31–Green

Upgrades Coverage

This form modifies the policy to account for the added cost

and expense to settle property losses involving structural property that has

been certified as being green products. Property must qualify by an

organization that the insurer defines as a “Green standards-setter.” The amount

of coverage for green upgrades and additional expenses appear in the form’s

schedule. When the optional coverage for a vegetated roof is selected, the

applicable policy’s definition of land is modified so that a coverage exception

is granted.

HO 06 33–Mechanical

Breakdown Coverage

This option provides equipment breakdown protection for

household appliances, such as central air conditioning, chairlifts, elevators,

heating systems, etc. The amount of coverage appears in the form’s schedule and

it operates during the policy period as an aggregate limit. Coverage is settled

on an actual cash value basis.

HO 07 01–Home

Business Insurance Coverage

This endorsement is quite extensive, with the structure of a

self-contained policy. It provides both property and liability coverage for

losses related to a described business that is operated in the insured’s

residence or other structure, such as an unattached garage, that is located on

the residence premises.

Related Articles:

Home–Based

Business Considerations

Home–Based Business Questionnaire

HO 07 01–Home Business Insurance Coverage

HO 07 50–Additional Insured–Managers or Lessors of Premises Leased To an

Insured

(Used with HO 07 01–Home Business Insurance Coverage)

Extends limited protection to scheduled (listed) parties who

either manage or lease the described premises that an insured uses in

connection to a business activity insured by the HO 07 01 Form.

HO 07 51–Additional Insured–Vendors

(Used with HO 07 01–Home Business Insurance Coverage)

Extends limited liability protection to scheduled (listed)

parties who distribute the described products that are related to a business

activity described on the HO 07 01 schedule.

HO 07 52–Loss Payable

Provisions

(Used with HO 07 01–Home Business Insurance Coverage)

Extends protection to the listed parties for their insurable

interest in the property used by an insured in the business activity described

on the HO 07 01 schedule. The loss payable is entitled to a notice of

cancellation or nonrenewal.

HO 07 53–Exclusions–Personal

and Advertising Injury

(Used with HO 07 01–Home Business Insurance Coverage)

Specifically excludes coverage for personal and advertising

injury loss related to the business activity described on the HO 07 01 schedule.

HO 07 54–Liquor

Liability Exclusion and Exception for Scheduled Activities

(Used with HO 07 01–Home Business Insurance Coverage)

Excludes coverage for liquor liability losses related to the

business activity described on the HO 07 01 schedule. However, the form permits

an exception by providing coverage for activity(s) scheduled on the endorsement

but only for the scheduled period.

HO 07 55–Special

Coverage–Spoilage Of Perishable Stock

(Used with HO 07 01–Home Business Insurance Coverage)

Adds coverage for the perishable stock described in the

form’s schedule but only when the loss is the result of mechanical breakdown,

contamination or power outage. Definitions for “perishable stock,” “breakdown

or contamination,” “power outage,” and “loss of power are part of the

endorsement. The limit must be shown in the schedule. The stock must be at the business

location described on the HO 07 01.

HO 07 56–Valuable

Papers and Records Coverage Increased Limits

(Used with HO 07 01–Home Business Insurance Coverage)

This endorsement increases the limit of $2,500 in the HO 07

01 to whatever limit show in the schedule.

HO 07 57–Special

Coverage For Valuable Papers And Records

(Used with HO 07 01–Home Business Insurance Coverage)

This expands Valuable Paper and Records coverage in the HO

07 01 to perils of physical loss with exception of the listed exclusions and

also applies to not only owned papers and records but also those in the

insured’s care, custody and control.

HO 07 58–Sections I and

II Exclusions for Computer-Related Damage or Injury

(Used with HO 07 01–Home Business Insurance Coverage)

This form excludes any computer hardware or software loss,

direct or indirect, that is related to a covered business but only if the loss

is caused by a failure or inability to process, access, recognize, etc information

because of a date such as year 2000.

HO 07 59–Sections I and

II–Limited Coverage for Year 2000 Computer-Related and Other Electronic

Problems

(Used with HO 07 01–Home Business Insurance Coverage)

This form is used when the HO 07 58 is attached. It opens

the window just slightly to provide loss of business income suffered by an

insured business activity because of a programming or similar malfunctions

related to any date-based cause (i.e., such as the Year 2000 situation). The

form provides a maximum of $25,000 for a given, eligible incident.

HO 12 45–Change

Endorsement

This is used to make changes to the homeowners

policy.

HO 12 76–Homeowners

Rating Information

This form includes information on the various elements of a

homeowner risk which are used to develop the proper premium such as the home’s

construction type, policy form, fire district, deductible, territory, etc.

HO 17 31–Unit-Owner's

Coverage C Special Coverage Form

(Used with HO 00 06 only)

This form is used to upgrade the Perils Insured Against

(named perils) for personal property from a broad form to a special form basis

in which there is coverage for all physical causes of loss which are not

specifically excluded.

HO 17 32–Unit-Owners

Coverage A Special Coverage Form

(Used with HO 00 06 only)

May be attached to convert the "built-in" coverage

that applies to additions and alterations made by an insured from a broad form

to a special form basis.

HO 17 33–Unit-Owners

Rental to Others

(Used with HO 00 06 only)

This provides coverage for personal property when the premises is regularly rented to others. The endorsement also

extends personal liability coverage to the rental of the residence premises.

HO 24 10–Personal

Injury Coverage (Aggregate Limit of Liability)

This endorsement adds coverage for personal injury. The form

defines it as any injury arising out of false arrest, detention or

imprisonment, or malicious prosecution; libel, slander or defamation of

character; invasion of privacy; or wrongful eviction or wrongful entry. It is

identical to HO 24 82–Personal Injury Endorsement except for the addition of an

aggregate limit of liability.

Related Article: HO 24 82–Personal Injury

Endorsement

HO 24 13–Incidental

Low Power Recreational Motor Vehicle Liability Coverage Endorsement

The 1991 edition of this form was called Incidental Motorized Land

Conveyances. The current title better reflects the fact that it adds off

premises coverage for vehicles (not golf carts, motorized bicycles or mopeds)

not licensed for road use and incapable of going more than 15 MPH. Besides covering the named insured and his

resident relatives, protection extends to persons or organizations that are

legally responsible for a covered “motor vehicle.”

HO 24 43–Permitted

Incidental Occupancies–Other Residence

This endorsement is available to provide liability insurance

for an insured’s incidental business activity that’s performed at premises

situated at another location (not the described premises appearing on the

declarations). Both the address and a description of the activity must appear

either on the endorsement or elsewhere on the policy.

HO

24 64–Owned Snowmobile

This endorsement may be attached to a homeowners

policy to provide personal liability coverage and medical payments coverage for

owned, scheduled snowmobiles.

Related Article: HO 24 64–ISO Owned Snowmobile

Endorsement

HO 24 70–Additional Residence Rented to Others–1, 2, 3 Or 4 Families

This endorsement provides coverage for additional one or

two, three or four family residence premises, rented to others and owned by the

named insured or spouse. The endorsement extends the definition of

"insured premises" contained in the policy to include the scheduled

locations under Coverages E and F.

HO 24 71–Business

Pursuits

This endorsement may be attached to a homeowners

policy to provide coverage for the liability of an insured arising out of

business activities, other than a business of which the insured is sole owner

or a partner. Eligible business pursuits include clerical office employees,

salespersons, collectors, messengers and teachers. Teachers have the option of

including liability coverage for corporal punishment.

Related Article: HO 24 71– Business Pursuits

Endorsement.

HO 24 72–Incidental

Farming Personal Liability

This endorsement extends coverage to incidental farming activities

at the residence premises.

Related Article: HO 24 72-Incidental Farming

Personal Liability

HO 24 73–Farmers

Personal Liability

This endorsement may be attached to a homeowners

policy to cover farm liability exposure of a risk that would otherwise qualify

for coverage under a basic, ISO homeowner policy. Since the intent is to cover

modest farm operations, the endorsement does not cover farms which supply

commodities for manufacturing or processing by the insured for sale to others,

such as creameries and dairies (but not dairy farms), farms operating freezing

or dehydrating plants, and poultry factories.

Related Article: HO 24 73–ISO Farmers Personal

Liability Endorsement

HO 24 75–Watercraft

This endorsement provides liability coverage for a described

watercraft with outboard motor or combination of outboard motors of more than

25 total horsepower and described sailing vessels. These

watercraft would not be covered under an unendorsed homeowners policy. Coverage

for other boat types is available under yacht policies.

Related Article: HO 24 75-Watercraft

HO 24 77–Canine

Liability Exclusion Endorsement

This form is a named dog exclusion.

Space is provided to enter a name and description of a dog. When attached, it

eliminates BI and PD caused by the described dog. The exclusion applies to that

dog whether it is owned as well as in the care, custody or control of an

insured.

Note: The form

may be problematic to apply to non-owned animal situations. What would be the

circumstances that this endorsement would be executed for non-owned dogs?

Further, how would enforcement be affected by a dog’s

name change or an ambiguous description. A photo or micro chipping requirement

may have made sense.

HO 24 82–Personal

Injury Coverage

This endorsement adds coverage for personal injury. The form

defines it as any injury arising out of false arrest, detention or

imprisonment, or malicious prosecution; libel, slander or defamation of

character; invasion of privacy; or wrongful eviction or wrongful entry.

Related Article: HO 24 82–Personal Injury

Endorsement

HO 24

96–Exclusion Of Farm Employees Illegally Employed.

This form excludes liability coverage for injury to an

insured’s farm employee if that insured knows that employment is in violation

of the law. .Examples could include the employing of children in violation of

child labor laws and the employing of non-citizens without appropriate

certifications.