AAIS COMMERCIAL OUTPUT PROGRAM (COP) ARCHIVE

(June 2025)

|

|

This is a repository

of articles and analyses relating to earlier editions of the program indicated

above.

Related Article: CO 1000–Commercial Output Program Property Coverage Part Analysis reviews the most current form.

|

Archive Index |

|

|

Common Policy

Conditions |

CL 0100–AAIS

Commercial Lines Common Policy Conditions 03 99 edition |

|

Analysis |

AAIS Commercial

Output Policy Edition 2.0 Analysis |

|

Analysis |

AAIS Commercial

Output Policy Edition 2.0 Endorsements |

|

Comparison |

AAIS COP 2.0 Edition Vs. ISO Special Commercial Property 06 95 Edition |

|

Comparison |

AAIS Commercial Output Policy Edition 2.0 Vs. The Manufacturers Output Policy |

CL 0100–AAIS COMMERCIAL LINES COMMON POLICY CONDITIONS

INTRODUCTION

Most American Association of Insurance Services (AAIS) commercial lines policy require attaching CL 0100–Common Policy Conditions. It contains five conditions:

- Assignment

- Cancellation

- Change, Modification, or Waiver of Policy Terms

- Inspection and Surveys

- Examination

1.

ASSIGNMENT

This policy cannot be assigned. The only exception to this condition is

when the insurance company provides its consent and even then, that consent

must be in writing.

This is a

condition necessary in order to guard the integrity of underwriting. The named

insured is the starting point of all underwriting. If the named insured changes

through assignment, a complete re-underwriting of the account must occur. The

exception to this condition allows the insurance company to permit such

assignment after it has been able to review the request.

|

Example: Nancy, Becky, and Lyla own a business named NBL, LLP. Scenario 1:

Their financial manager is recommending that they incorporate and change the

name to NBL, Inc. No other change is occurring but NBL, LLP would like to

assign its policy to NBL, Inc. The underwriter reviews the request and agrees

to the assignment without any change in the policy. Scenario 2:

Nancy, Becky, and Lyla want to walk

away from the business and Charlie has offered to buy it. In order to make

the deal happen quickly, he asks that they assign the NBL, LLP policy to him.

Because of this condition, any assignment NBL, LLP makes is not valid and

will void coverage. |

2.

CANCELLATION

This condition explains how cancellations are handled. Many states require using a mandatory state form in place of this cancellation condition, but this is a good starting place.

The named insured can cancel the policy. If there are multiple named insureds, each one has the right to cancel because there is no condition limiting that right to a specific named insured.

The named insured can cancel coverage by returning the policy to the insurance company. It can also cancel it by writing to the insurance company and providing the date on which cancellation is to take place.

|

Example: Heidi and Jack are partners, and both are shown as insureds on their insurance policy. Heidi sends a request to the insurance company to cancel the policy without telling Jack. When a loss occurs and there is no coverage, Jack has no recourse against any party except Heidi. |

The insurance company can cancel by mailing or delivering a written notice to the named insured. It must be mailed to the latest mailing address the insurance company had been given. The notice must state the exact date on which the cancellation is to be effective. Proof of mailing is required but a signed receipt is not.

The insurance company notice must give the named insured at least ten days’ notice when the reason for cancellation is nonpayment of premium.

If the cancellation is for a reason other than nonpayment, the insurance company must give the named insured at least 30 days’ notice.

|

Example: Dravens, Inc. receives a notice of

cancellation from its insurance carrier. It was mailed on 3/1/16 with the

cancellation to become effective on 3/28/16. Scenario 1: The reason for cancellation is nonpayment

of premium. The cancellation is effective 3/28/16. Scenario 2: The reason for cancellation is failing to

resolve loss prevention recommendations. The cancellation cannot go into

effect because the notice period is too short. The policy continues in force.

|

The named insured receives a return premium when the policy is

cancelled. The return premium is based on the insurance company rules. This

means it may be prorate, short rate, or

another type of calculation but it must be consistent for all named insureds.

The cancellation is in effect even if the

named insured did not receive the return premium.

3.

CHANGE, MODIFICATION, OR WAIVER OF POLICY TERMS

The policy that the insurance company issues represents the agreement it makes with the named insured. If the named insured requests a change to that policy, the insurance company has the right to accept or reject the request. Because the insurance policy writes the policy it also determines what changes can be added to the policy. However, these changes are not meant to be kept secret. Therefore, any change made must be in writing and issued by the insurance company.

|

Example: Nellie sends an email to her agent

notifying him that she just bought a new tractor and asks that it be added to

her policy. She assumes the email was received and never follows up. The

tractor is destroyed in a windstorm and Nellie sends a claim notice to the

insurance company. The company denies the claim because the tractor is not on

the policy. |

4.

INSPECTIONS

The insurance company is

not obligated to make inspections of the named insured’s property, but it has

the right to do so and the named insured is expected to cooperate.

Any inspection conducted is intended solely for the insurance company’s benefit.

The insurance company may provide recommendations or advice, but nothing provided is to be considered a statement that the named insured’s operation comply with any specific laws or regulations.

|

Example: Pretty

Interested Insurance Company inspects Unity Plus. The loss prevention

specialist is very impressed with the many innovations in the building and

overlooks some of the very basic life safety features that were compromised

by the innovations. When a fire occurs and lives are lost, Pretty Interested

Insurance cannot be held liable because its employee failed to notice the

life safety failures. |

5.

EXAMINATION OF BOOKS AND RECORDS

The insurance company has

the right to review the named insured's books and records. However, this right

is restricted to only the ones that relate to this policy. This right extends

throughout the policy term and for up to three years after.

AAIS COMMERCIAL OUTPUT POLICY EDITION 2.0 ANALYSIS

AGREEMENT

When "you" pay your premiums "we" provide the coverage described in the policy, subject to the terms of the policy. The Declarations Page is considered a part of this policy along with the policy conditions relating to assignment, transfer of rights, cancellation, policy changes, inspections and examinations of books and records.

Any endorsements and schedules become part of the policy and these are identified on the Declarations Page. Words that are specifically defined are shown in quotations or are emboldened.

DEFINITIONS

Defined words are used throughout the policy, but their meaning is consistently the same as defined here, thus limiting the company’s, the insured’s, and the courts’ focus on what the company intended each word to mean. (See Defined Words at the end of this analysis.)

1. "You" and "Your" define who is being insured. "You" and "Your" are the persons or organizations named in the Declarations Page and identified as insureds. Therefore, it is critical that all insureds be positively identified. If a business should purchase, sell, or create new entities during the course of the policy period, it is imperative that these new entities be added. Using et al, for all entities that may be acquired during the policy period, or similar omnibus language, is not acceptable. Define each covered entity and add or delete as necessary during the policy period.

2. "We", "us" and "our" are the insurance company providing coverage.

3. "Computers" are "hardware" in your care, custody or control, and “software.” Hardware" and "Software" are later specifically defined. Note that hardware must be in your care, custody or control including owned hardware and hardware belonging to others, but software can be a product you own but lease or lend to others, or software of others in your possession.

4. "Covered locations" are any location or premises where "you" have buildings, structures or business personal property covered under this coverage. Unless the Locations Endorsement COP-227 and Scheduled Locations Endorsement COP-226 are added to the policy, covered locations are defined by policy language and include virtually any place within the coverage territory that the insured has property, or is working. Exceptions are—radio and TV antennas, satellite dishes and accompanying equipment, awnings and fences are only covered within 1000 feet of a covered structure or building. Other property may have special limits of liability that can be less than the blanket policy limit of insurance.

With the Scheduled Locations Endorsement, coverage is narrowed to specifically described locations and some off premises locations.

5. "Declarations" include pages labeled either "Declarations," Supplemental Declarations or schedules.

6. "Fine arts" are defined as: paintings, etchings, pictures, tapestries, art glass windows, and other bona fide works of art of rarity, historical value, or artistic merit. With some items, this definition is specific. With items like sculptures, the interpretation of whether the work is a "fine art" depends upon an expert declaration that the work is bona fide or a legitimate work of art. Bona fide, rarity, historical value, and artistic merit will be subject to interpretation in any dispute. "Fine arts" coverage is limited to $50,000 and cannot be increased by any standard COP endorsement; therefore, any artwork, collectibles, stained glass windows, and antiques should be carefully valued. If coverage needs exceed $50,000, then a commercial fine arts policy should be considered.

Valuation of "fine arts" is important and at the time of a loss, "fine arts" are valued at actual cash value without depreciation. Certain items may be scheduled for a predetermined agreed value using the Agreed Amount Endorsement COP-254.

7. "Hardware" means: a network of electronic machine components capable of accepting instructions and information, processing the information according to the instructions, and producing desired results. Computers, network, peripherals, printers, fax machines, photocopiers, calculators, hand held or laptop computers are included within this definition. Telephone systems and other electronic communication networks would also come under the definition of "hardware."

8. "Limit" is the amount of coverage that applies. For most insureds under this policy, coverage will be blanket. That means that a limit combining buildings, owned personal property, and property of others will be combined into one limit of insurance and that limit will be listed on the Declarations Page. Using other endorsements, like the Scheduled Locations Endorsement COP-226, or the Agreed Amount Endorsement COP-254, will set specific limits of coverage for defined locations, buildings or personal property. Within the policy, certain property will carry specific limits per item (see ADDITIONAL COVERAGES, SUPPLEMENTAL COVERAGES, SUPPLEMENTAL MARINE COVERAGES, ADDITIONAL PROPERTY NOT COVERED OR SUBJECT TO LIMITATIONS, for property with predetermined policy limits). Most items with predetermined policy limits can be increased by endorsement.

9. "Mobile equipment" includes contractors’ equipment—mobile or floating, self propelled vehicles designed to carry and are primarily used to transport mounted equipment, and vehicles that normally are designed for highway use but are unlicensed and do not operate on public roads.

Though contractors’ equipment is not specifically defined, it would include bulldozers, cranes, graders, shovels, dredges, mining equipment, logging machinery, well drilling equipment (including on and off shore but subject to continental U.S. boundaries).

Vehicles that carry mounted equipment can include cherry pickers, welding trucks, and towed compressors. Logging trucks with cranes to load and unload lumber, and redi-mix trucks would not be "mobile equipment" because their primary use is to transport product. Also, a flatbed designed to carry a bulldozer would not be "mobile equipment" because the bulldozer is not permanently attached to the flatbed. A self-propelled crane would be considered "mobile equipment." Dump trucks, snowplows, farm-type tractors and other vehicles used to service the premises or the building site are considered "mobile equipment" if they are not licensed. A licensed dump truck that is used only on the job site and is transported to the job site on a flatbed trailer would not be considered "mobile equipment" unless the dump truck was not designed for road use.

10. "Pollutant" is virtually any kind of solid, gas, thermal, electromagnetic, or sound contaminant or irritant. Wastes, including recycled, reclaimed or reconditioned materials, are also considered "pollutants." Electromagnetic pollution can mean stray voltage, microwave radiation, excessive light from lamps, or high tension wire radiation. Sound pollution can include loud music, machinery noise and the resulting damage done by excessive vibration due to sound. This policy is inappropriate for any company that deals in the cast-offs of others, including waste haulers, recyclers, used materials dealers, or used oil reclaimers.

11. "Sinkhole collapse" is a sudden collapse of earth due to the action of water creating holes or caverns in limestone or other rock formations. Sinkholes are often created by subterranean rivers, excessive flow of water after rains that seep into the ground, or burst pipes that cause subsidence of the land. The cost of filling the land, or the land itself is not covered by the policy.

12. "Software" is both the material on which the data is stored (media) and the data itself. Software can include tapes, disks, cards, films, drums, cartridges or cells used with computers or other electronic data processing operations. The data is the coded instructions on the media. Information hard coded into a computer chip such as in a non-programmable calculator would be considered part of "hardware." A font card for the laser printer would be considered "software."

13. "Specified perils": There are certain types of property—animals, glassware/fragile articles—where risks of physical loss coverage will be too broad for most insurance companies to insure. Covered "specified perils" are limited to: aircraft, civil commotion, explosion, falling objects, fire, hail, leakage from fire extinguishing equipment, lightning, riot, "sinkhole collapse," smoke, sonic boom, vandalism, weight of ice snow or sleet, and windstorm. Falling objects can include buildings, trees, objects dropped from airplanes or aerial cranes; but damage to personal property in the open, or through openings in the building not first opened by the falling object (open windows or doors) breaking through a wall or roof, are not covered. Water damage is limited to water or steam that leaks or discharges from an accidentally cracked or broken system or appliance that contains the water or steam. Systems and appliances can include water pipes, heating pipes, water heaters, sprinkler systems, water boilers, dishwashers, ice makers, defrosting freezers. Under PERILS EXCLUDED—g. Water, back-up of sewers or drains or flood are not considered water damage. PERILS EXCLUDED—2. g. Explosion, the loss caused by boiler explosion (other than due to an explosion of accumulated fuel in the fire box or flue) is not covered, but the resulting damage from water release would be covered. PERILS EXCLUDED—2. h. Freezing, limits the damage from burst pipes due to freezing conditions unless the water system was shut off, steps were taken to maintain heat, or the system was appropriately winterized. PERILS EXCLUDED—2. n. Seepage—water damage due to repeated or continuous leaking over a period of 14 days or more is not covered.

14. "Terms" include: provisions, limitations, exclusions, conditions, and definitions that apply to a particular type property or situation described in the policy. "Terms" is another way of suggesting to the insured that he/she review all portions of the policy to find terminology that applies.

15. "Valuable papers and records" can be handwritten or printed documents or material on films. Included within the definition of "valuable papers and records" are manuscripts, motion picture and other films, blueprints, charts and graphs, books and manuscripts, deeds, abstracts and mortgages, maps and other paper records. Operations manuals, sketches of ideas, patents also would be "valuable papers."

16. "Volcanic action" is not volcanic eruption. Volcanic eruption involves earth movement. Volcanic action includes the airborne blast of ash, dust, or particles and includes airborne shock waves. Lava flow is also considered volcanic action. Damage caused by the volcanic action is covered, including cleanup of the damaged building and business personal property, but the cost to remove ash, dust or particles from undamaged property is not covered.

PROPERTY COVERED

Property first must sustain direct physical loss to be covered.

Consequential loss, such as loss of business income from the damage is not covered unless Business Income coverage is added. Also not covered is indirect loss, including loss of product value or sales as a result of sabotage or tampering to select stock.

PROPERTY COVERED—BUILDING PROPERTY

Buildings and structures include:

1. Completed additions to existing buildings and structures.

2. A permanent part of a covered building or structure, the fixtures, machinery and equipment. Within the ISO rating structure, it is important to distinguish between buildings and personal property, for personal property usually carries a higher base rate. The COP looks at cumulative exposure points based upon the entire range of covered property, so assigning value to either building or personal property is less important. The distinction only becomes important if the Scheduled Locations Endorsement COP-226 is added and separate limits of insurance are selected. In that event, determining what is a building and what is personal property becomes an important consideration.

3. Outdoor fixtures. The word fixtures implies permanence; therefore, lawn furniture and other moveable items would not be considered fixtures. Permanent fountains, street lights, sprinkler irrigation systems and the like would be considered fixtures. Keep in mind though, that property in the open is not covered for the perils of rain, snow, ice or sleet, and underground pipes, flues and drains are limited to $250,000 coverage included with foundations and piers and wharves.

4. "Your" personal property used to maintain or service a covered building, structure, or the premises. This would include lawn and garden tractors, snow removal equipment, and water hoses. Property specifically named includes: air conditioning equipment, fire extinguishers and sprinkler systems, floor coverings. Refrigeration, cooking, dishwashing and laundering equipment for the service of the building is covered. Employee cafeteria refrigerating, cooking, dishwashing and laundry equipment would be considered part of the building. Hotel guest, patient, or other customers of restaurants or laundries would not be considered part of the building.

5. a. Buildings under construction, renovation or repair as long as they are not covered by other policies. The COP policy will substitute for a builders risk policy. Buildings covered by another policy—a builders risk policy, or "your" customer's own policy would not also be covered by the COP policy.

5. b. Contractors’ equipment used in conjunction with and materials and supplies and temporary structures intended for the construction, renovation or repair of a building or building additions is covered while at or within 1000 feet of the "covered locations." "Covered locations" has no meaning unless the Scheduled Locations Endorsement COP-226 is added to the policy. Without the Scheduled Locations Endorsement, materials intended for building construction, repair or installation would be covered at the insured's premises, at the site of construction, in storage in a nonowned warehouse, or at another processor (lumber owned by the insured being milled into cabinets or trusses). The COP policy will substitute for an installation policy for property to be installed while at the site of construction or renovation. The COP also will replace a contractors equipment policy giving full coverage for tools, equipment, and machinery owned by the insured while that contractors equipment is on a premises owned by the insured, or at a job site. Property intended for installation or contractors equipment while in transit is limited to $50,000 coverage. Coverage for in transit goods and equipment can be increased by using the Supplemental Limits Endorsement COP-229.

6. Building glass. Building glass includes glass building blocks, windows, door glass whether on exterior or interior walls. Glass objects, glass dials on equipment not connected with the building, and glass stock are not considered building glass.

7. Radio, TV towers and satellite dishes, lead-in wiring, support wires, their foundations and any equipment attached to any of this property (transmitters, transponders, back-up generators) are covered only if they are within 1000 feet of a covered building or structure. Fences and awnings or canopies must also meet the 1000 feet from a covered structure or building rule. A television station's antenna on the top of a mountain that is miles from the station would not be covered and cannot be added by a standard COP endorsement. Coverage for distant antennas can be covered using an inland marine or specialty property form. A question does arise if the antenna is connected to a shed or housing associated equipment. Is that shed a covered structure under the blanket coverage provided by the base policy? Extensive fencing around a premises is only covered for the length of fencing that remains within 1000 feet of the closest covered building.

8. Signs are covered under the policy wherever they are located—attached, detached, away from the premises or on the premises. Owned billboards are covered.

PROPERTY COVERED—BUSINESS PERSONAL PROPERTY

Business personal property can be in buildings, in the open, in vehicles or within 1000 feet of "covered locations."

1. As a tenant, business personal property includes "your" use interest in improvements to the building or structures "you" occupy, or do not own and make or acquire at "your" expense, and are of the kind that "you" cannot legally remove when you vacate the premises. Improvements are limited to fixtures, alterations, installations or additions. Improvements do not include personal property you acquire that must remain with the property—free standing refrigerators, nonfixed shelving. Improvements can be to the occupied structure, garages or any outbuildings. Common improvements include false ceilings, internal walls, light fixtures, improved wiring, telephone switching systems, cooking equipment, HVAC improvements, carpeting, built-in shelving, and common renovation such as new roofs by a company who has a lengthy lease. Improvements paid for by the landlord are not covered, and if improvements can be legally removed by "you" they would be covered under other business personal property provisions. Valuation of improvements is based upon use interest which is based upon a prorata portion of your original cost as it relates to the length of time between the date of installation and the expiration of "your" lease or any renewal option period. (See VALUATION 8—Tenants Improvements for more information.)

2. If "your" contract for leased personal property requires that "you" insure the property, the leased property is covered by COP. Common leased personal property includes computers, photocopiers, printing equipment, machine tools, diagnostic equipment. Leased mobile equipment would be covered as business personal property. The word lease is not defined and generally a lease can be of any duration. A crane leased (rented) for three days to perform tasks at a construction site where a contractual responsibility to insure exists is covered. Automobiles are not covered as personal property unless physical damage coverage is added by Schedule of Vehicles Endorsement COP-224.

3. When you repair, improve, process, modify or enhance property of others, your labor, materials and other services are considered insurable personal property. Taking a truck or van chassis and adding a body, modifying a customer's machine to add machine guards, screen printing slogans on a customer's tee shirts, adding fragrance to a detergent, packaging product for others all are examples of processes where "you" have coverage for your services. Your interest includes the labor at your rate for anyone involved in the process, the raw materials consumed including power, chemicals and any other services expended or provided for which a value can be determined.

4. "Computers" are covered if not insured by another policy. However, there is a provision in HOW MUCH WE PAY 5. that says that property covered by another policy will be covered by the COP policy on an excess basis. Because "computers" coverage is limited to this policy, the excess provision does not apply to computers. While "computers" are covered for many of the perils that plague electronic equipment (breakdown, humidity change and mold in ventilation after a loss), power surges, brownouts, and electrical shorts are not covered perils. The insured should consider purchasing endorsements COP-265—Additional Computer Coverages and COP-257—Off Premises Computer Coverage where AAIS has tried to provide coverage equivalent to an EDP policy for computers.

5. Personal property which will become a part of "your" installation, fabrication or erection project while on site or in temporary storage awaiting the installation. Personal property intended for installation is not restricted to a building or within 1000 feet of "covered locations."

Coverage is available for building or renovation contractors, millwrights, machine installers, and others who work on real or personal property away from their premises. Covered materials include, but are not limited to the following: lumber, steel erection, machines, HVAC and plumbing supplies, signs, machine parts, carpeting, flooring, brick, fencing, cement slabs. Trees, shrubs, lawns and plants coverage perils are limited to fire, lightning, explosion, riot or civil commotion and falling objects for a maximum of $50,000 per any one occurrence.

6. "Mobile equipment" is covered if not insured by another policy, and coverage is not limited at or within 1000 feet of "covered locations." There is a provision in HOW MUCH WE PAY 5. that says that property covered by another policy will be covered by the COP policy on an excess basis. Because "mobile equipment" coverage is limited to this policy, the excess provision does not apply to computers.

7. Personal property of others in your care, custody or control while on "your" property or elsewhere, includes personal property sold under an installation agreement for which "your" responsibility continues until the property is accepted by the buyer. Examples of coverage include: "your" dry cleaners bailee exposure; machinery and equipment of others you are processing, repairing, modifying at your plant; machines belonging to others at their plant while "you" are repairing or servicing; appliance repair person while working on a residential customer's major appliance. This provision does not apply to real property like buildings, including machinery, equipment, HVAC and plumbing that is considered to be part of the building. Payment for any covered loss will be made only for the benefit of the property owner, not to "you." Coverage for real property is available through specific property insurance in the case of leased buildings, or fire (and other perils) legal liability coverage under a general liability policy. Note, the liberalized care, custody or control provision of the CG 00 01 general liability policy does not provide coverage for personal property in your care, custody or control. Adequate coverage under the COP policy should be purchased to cover the value of the personal property in your care, custody or control. If "your" business involves the on site repair of multi-million dollar machines, appropriate limits should be selected based upon the possible maximum loss.

PROPERTY NOT COVERED

1. Airborne and waterborne

property is covered only while being transported by regularly scheduled

airlines or ferry service. Property in transit is limited to $50,000 coverage.

Coverage can be increased by using the Supplemental Limits Endorsement COP-229.

The coverage territory for the COP includes the

2. Aircraft and watercraft, including motors, equipment and accessories "you" manufacture, process, warehouse or hold for sale are considered covered personal property. This includes your property and property of others whether on "your" premises or at another's premises. In transit coverage is limited to $50,000. Property in the custody of sales personnel is limited to $50,000. The $50,000 limit on transportation can be increased by using Supplemental Limits Endorsement COP-229.

All other aircraft or watercraft including equipment and accessories that are operated principally away from "covered locations" are not covered. Rowboats and canoes at "covered locations" are covered while out of water.

Boat dealers, marinas, boat repair, boat hauling, dry docks, aircraft manufacturers, aircraft parts manufacturers, aircraft repair or sales are businesses for which coverage would apply. Airports and air hangar operations or berth-only marinas (no repair) involved in only parking (not warehousing) are not the kinds of business for which this coverage applies.

3. Animals "you" own and hold for sale, or owned by others and boarded by "you" are covered. All other animals, birds and fish are excluded. Animal boarders, pet stores, zoo and dairy replacement, feed lots, and beef, lamb, fish and pork farms are examples of businesses that own and sell or board animals. Covered animals do not include: veterinary services provided for the nonboarded animals, pet and guard animals, zoos, slaughter houses (resulting food products are covered), dairies, or laboratory animals (bred for "your" experiments, but bred for sale would be covered). COP eligibility does not include primarily agriculture businesses and animal coverage is limited as a result of eligibility restrictions.

4. Automobiles that are not "mobile equipment" are not covered. Excluded vehicles: automobiles, motor trucks (as opposed to hand trucks), tractors (over-the-road), trailers, and similar vehicles designed for over-the-road transportation of people and property.

Automobiles and vehicles, including motors, equipment and accessories "you" manufacture, process, or warehouse are considered covered personal property (automobile manufacturers, remanufacturers, van conversions). Automobiles or vehicles held for sale are not covered; thus, coverage is inappropriate for car dealers. Adding physical damage coverage for automobiles using Vehicle Coverage Endorsement COP-224 can provide specific or blanket coverage for vehicles, but no coverage is provided for vehicles held for sale. However, there is no comparable COP endorsement to the ISO Commercial Auto False Pretense Coverage CA 25 03. "Mobile equipment" considered to be personal property that is owned, manufactured, processed, warehoused, or held for sale is covered.

5. Contraband or property involved in illegal transportation or trade is excluded.

6. Outdoor crops such as grain, hay or straw are not covered. Covered crops would include wheat and corn in a grain elevator or in bins waiting to be processed into flour, indoor gardens, nurseries, or laboratories that create hybrid strains. Outdoors is generally defined as being outside a building or shelter. A question arises as to whether coverage would be extended to crops in transit in enclosed trailers, or property in enclosed vehicles while on a "covered location."

7. Exports and imports

that are covered under an ocean marine cargo or similar policy are not covered.

It doesn't matter who provides the coverage, "you" or another. The

term covered is used rather than the word insured. Thus, if the ocean marine

cargo policy excluded a particular loss that the COP policy did not, there

would be coverage provided by the COP policy, but only while the property was

within the COP's covered territory. The COP policy will not cover property

while it is outside of the

8. Any land, any underground or surface water, or the cost of any excavation grading or filling, will not be covered. The COP policy provides coverage for foundations and underground pipes, flues or drains (see SUPPLEMENTAL COVERAGES 4 for more information), but only for covered damage to the foundations or pipes, not the cost of excavation. Debris removal coverage (ADDITIONAL COVERAGES 1.) pays for the removal of covered property damaged by a covered peril. The lifting from the ground and the transportation of the underground pipe would be a covered debris removal expense, but the digging out of the pipe would not be a covered debris removal expense.

9. Money, notes. securities, accounts, bills, currency, food stamps, evidence of debt, lottery tickets not held for sale are not covered. Lottery tickets held for sale are considered covered property. Consult individual state lottery statutes for laws governing vendors’ responsibility for lost, stolen or wrongfully converted lottery instruments.

10. Property that is more specifically insured by another insurance policy is covered only on an excess basis. However, the excess coverage does not apply to "Computers" and "Mobile Equipment" if covered under another policy. Again, the word is covered and not insured. If the computer policy excludes a particular peril that the COP policy covers, then the COP will provide primary insurance.

11. If, at the time of the loss, "you" are responsible for the property of others and you are acting as a carrier for hire or an arranger of transportation, there is no coverage for property of others. Situations where "you" are considered a carrier for hire include: car-loading, freight forwarding, brokering, backhauling, or shipping association. A properly prepared Motor Truck Cargo or Transportation Policy is recommended to provide coverage.

12. Property "you" have sold after it has been delivered is not covered. Under PROPERTY COVERED, BUSINESS PERSONAL PROPERTY 7, personal property sold under an installation agreement for which "your" responsibility continues until the property is accepted by the buyer is covered. However, the clause in this provision does not restrict property sold under an installation agreement to personal property. Coverage is then available for buildings and other real property sold under an installation agreement.

ADDITIONAL COVERAGES

1. DEBRIS REMOVAL

The cost of removing the debris of covered property after a covered loss is limited to 25% of the amount paid for the direct loss plus $5,000. The combined loss due to damage of covered property and debris removal cannot exceed the limit of insurance plus $5,000.

Example (1): The limit of insurance is $1,000,000. After a total loss, the damage to the building was $300,000, to owned business personal property—$400,000, to property of others- $200,000, and the debris removal expense of $200,000 was expended. The total loss was $1,100,000. The amount paid by the insurance company was $1,005,000. (The debris removal loss was 22% of the loss, but the total amount of loss exceeded the limit of insurance.)

Example (2): The limit of insurance is $1,000,000. The loss to the property was $500,000, but the debris removal cost was $300,000, for a total claim of $800,000—which is comfortably within the limit of insurance. However, debris removal coverage is limited to 25% of the paid loss. 25% of the paid loss is $125,000, and the supplemental $5,000 coverage is available, thus $130,000 of the $300,000 debris removal loss is paid.

Debris removal does not include extracting pollutants from land or water or the cost of removing, restoring or replacing polluted land or water. (Limited pollutant cleanup and removal is provided for up to $25,000—see ADDITIONAL COVERAGES 4.)

Debris removal due to the operation of ordinance or law is limited to $50,000 (see SUPPLEMENTAL COVERAGES 7 for more information about ordinance or law coverages.)

Debris removal expenses must be reported, in writing, to the insurance carrier within 180 days of direct physical loss to the covered property.

Examples of covered expenses include: demolition, use of a wrecking ball, transportation of debris, blasting to the ground a damaged structure, removing damaged inventory or equipment. Repairs made to shore up an undamaged building or shelter machinery, equipment and inventory during the debris removal process would not be considered debris removal, but would be covered as direct property damage under the clauses dealing with protecting the property from further damage and emergency removal after a loss.

(08/98 Changes: The following is a newly available endorsement providing optional increased limits.)

The coverage limit for Debris Removal can be increased by using endorsement COP-268—Increased Limits Endorsement.

2. EMERGENCY REMOVAL

Emergency removal covers property (for up to 10 days) while in transit and while it is at another location or in storage for any covered peril if it is moved in order to prevent or reduce the amount of damage to property that was originally threatened by an insured peril. For example, the machine shop roof blew off in a storm, the company moved the machines to a temporary you-store-it location, but the storage location burns down and destroys the machinery—coverage exists. Emergency removal coverage under the COP increases transportation coverage to the limit of insurance (from $50,000). If the Scheduled Locations Endorsement COP-226 is added to the policy, for emergency removal, the policy reverts to blanket location coverage.

(08/98 Changes: The following is a newly

available endorsement providing optional increased limits.)

The coverage limit for Emergency Removal can be increased by using endorsement COP-269—Increased Limits Endorsement.

3. FIRE DEPARTMENT SERVICE CHARGE

Up to $5,000 is available to pay fire department service charges incurred when property is threatened by an insured peril. Any covered service charge must be required by contract or agreement with the fire departments that respond. No deductible applies to this coverage.

(08/98 Changes: The following is a newly

available endorsement providing optional increased limits.)

The coverage limit for Fire Department Service Charge can be increased by using endorsement COP-269—Increased Limits Endorsement.

4. POLLUTANT CLEANUP AND REMOVAL

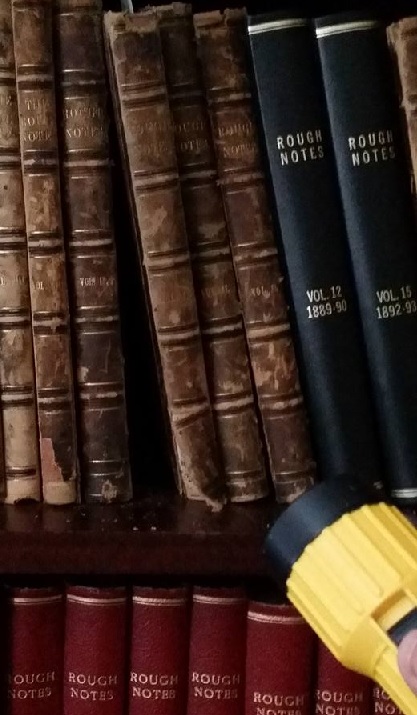

$25,000 aggregate annual and per site coverage is available to extract "pollutants" from land or water that are caused by a covered peril. The incident must occur during the policy period and be reported, in writing, to the insurance company within 180 days of the date the covered peril occurs. Extracting pollutants includes digging, dredging, well drilling, scraping land or water and then the transportation of the pollutants to an approved disposal site. Any form of testing soil, test wells, chemical analysis, well analysis, laboratory studies is not covered by the policy. Expenses do not include any court or defense costs associated with a pollution incident. Examples of sudden pollution release include damage to an aboveground pesticide tank after a roof collapses due to the weight of ice and snow. An example of gradual release (must be reported within 180 days) is fire loss to the building, where a collapsing floor damages the concrete basement and cracks the underground oil tank. Oil is discovered in the private well of the home next door within 180 days. After analysis it is deemed that the damage to the tank was caused by the fire. Removal of the underground tank and the cost of repairs to the tank are not covered by the policy, but the removal of the oil soaked soil is covered for up to $25,000. Damage to the foundation that must be removed to expose the offending tank and soil is covered under the original cause of loss—fire, and is not subject to the $25,000 limitation. $25,000 pollution cleanup is inadequate for all but the most minor of spills and there is no standard endorsement available to increase coverage. Consult the Specialty Markets for EIL—Environmental Impairment Liability Coverage (Markets are found in The Insurance Marketplace a publication of The Rough Notes Company, Inc.).

(08/98 Changes: The following is a newly

available endorsement providing optional increased limits.)

The coverage limit for Pollutant Cleanup and Removal can be increased by using endorsement COP-269—Increased Limits Endorsement.

5. RECHARGE OF FIRE PROTECTION EQUIPMENT

The expense of recharging automatic fire protection equipment is covered for up to $10,000 after discharge to combat any covered peril. Coverage includes refilling Halon, Ansul tanks, and the cost of filling large internal sprinkler system reservoirs with water or other fire suppressants. This coverage does not pay to recharge manual systems such as hand-held fire extinguishers, or water discharged from manual standpipe and hoses.

(08/98 Changes: The following is a newly

available endorsement providing optional increased limits.)

The coverage limit for Fire Protection Equipment Recharge can be increased by using endorsement COP-269—Increased Limits Endorsement.

SUPPLEMENTAL COVERAGES

All of the supplemental coverages are not subject to coinsurance if a coinsurance clause (Locations Endorsement COP-227) is added to the policy, and if the Scheduled Locations Endorsement COP-226 is added, and then only while property is in or outside of "covered locations," or within 1000 feet thereof. As always, a covered peril must first cause direct physical damage.

1. ARSON REWARD

An arson conviction as a result of information supplied by any one or a number of informants will be rewarded. $5,000 is available per arson loss, not per informant.

(08/98 Changes: The following is a newly

available endorsement providing optional increased limits.)

The

coverage limit for Arson Reward can be increased by using endorsement

COP-269—Increased Limits Endorsement.

2. BRANDS OR LABELS EXPENSE

Up to $50,000 is available for the expense of removing old labels and relabeling any business personal property that can be salvaged and resold. "You" must be careful not to damage the packaging or the property during the course of relabeling.

If "you" are required to relabel goods by law, "you" must do so, even if the expense exceeds $50,000.

Example: A high fashion men's clothing store has a limited but smoky fire. Salvaged clothing is dry cleaned and for the most part, the smoke damage is removed. However, store management and the insurance carrier agree that the store's customers will not purchase smoke damaged clothing at any price, and the contract that the store has with three specialty clothing vendors prohibits the sale of merchandise that displays their labels on any merchandise so damaged. The insured agrees to sell the damaged goods at its discount store. The insurance company agrees to pay the clothing store to have all the designer labels removed and the salvage brand's labels sewn in their places.

(08/98 Changes: The following is a newly

available endorsement providing optional increased limits.)

The coverage limit for Brands or Labels Expense can be increased by using endorsement COP-269—Increased Limits Endorsement.

3. CONSEQUENTIAL LOSS

Consequential losses to undamaged personal property of up to $10,000 are payable by the policy. Consequential loss is best described by example. Spillage of fuel ignites a fire which damages the paint on one of the lawn tractors your business sells. The repainted tractor cannot be resold as new, and is discounted $1,000 for sale as damaged goods. The $1,000 discount is covered as a consequential loss.

ISO provides similar coverage for manufactured stock through CP 99 02 Manufacturers Consequential Loss Assumption Endorsement attached to a commercial property policy to pay for the reduction in value of the remaining parts of stock in process when the reduction is caused by loss to other stock.

(08/98 Changes: The following is a newly

available endorsement providing optional increased limits.)

The coverage limit for Consequential Loss can be increased by using endorsement COP-269—Increased Limits Endorsement.

4. FOUNDATIONS OF BUILDINGS, PILINGS, AND UNDERGROUND PIPES

10% of the limit of

insurance to a maximum of $250,000 is available to pay (at any one

"covered location") for foundations of buildings, structures,

machinery or boilers if their foundations are below the lowest basement floor

(or the ground if there is no basement), pilings, piers, wharves, docks or

retaining walls, or underground pipes, flues or drains. Underground tanks are

excluded from coverage. Foundations of structures can include specially

constructed slabs for external and internal machinery. Docks on foundations and

pilings away from shore can also be covered if they are within the continental

limit of the

(08/98 Changes: The following is a newly

available endorsement providing optional increased limits.)

The coverage limit for foundations, pilings and underground pipes can be increased by using endorsement COP-269—Increased Limits Endorsement.

5. INVENTORY AND APPRAISALS EXPENSES

Up to $50,000 is available to pay for the cost of conducting an inventory or the cost associated with obtaining appraisals on any covered property that is damaged in a covered loss. The insurance company first must request that the inventory or appraisal be conducted before payment is made. Expenses can include: hiring part time individuals to sift through and record inventory, paying the daily fee for and transportation and living expenses of a recognized expert to appraise certain fine arts that were lost in the fire. Public adjuster expenses are never covered and appraisal expenses paid for by this policy in OTHER CONDITIONS—1. Appraisals, are not duplicated here.

(08/98 Changes: The following is a newly

available endorsement providing optional increased limits.)

The coverage limit for Inventory and Appraisals Expenses can be increased by using endorsement COP-269—Increased Limits Endorsement.

6. NEWLY ACQUIRED BUILDINGS

All locations, whether existing at the inception of the policy or acquired or built during the policy period, are covered by the policy except when the Locations Endorsement—COP-227 and Scheduled Locations Endorsement—COP-226 are added to the policy. When these two endorsements are added, coverage exists only for scheduled "covered locations." With these two endorsements, there is an additional provision that is activated in the base policy that adds up to $500,000 coverage for each newly acquired or constructed building for a period of 90 days or until the day you report the acquired location to the company, or the end of the policy period, whichever comes first. "You" must pay for the insurance from the date of acquisition or the day construction begins on the property. Coverage is per occurrence, so if you acquire three buildings in one sale, you have up to $500,000 coverage for each building. No standard COP endorsement exists to increase coverage above $500,000.

7. ORDINANCE OR LAW

Ordinance or law coverage pays for the cost of demolishing the undamaged portion of real property, the cost to repair the property and any increased cost of construction incurred during the reconstruction of the building so ordered by an official that is required by building code, zoning, or land use code at any "covered locations"; the ordinance or law must be in force at the time of the loss. Up to $50,000 coverage is available.

Example: A fire damages 65% of the beams and structure of a frame building used to house a candle manufacturer. City ordinances require that a building that is more than 60% structurally damaged by a fire or other peril must be torn down. City building codes require that any business using any process that heats any flammable liquid to within 80% or more of its flash point must be housed in a masonry building that is sprinklered, and is wired to meet specific explosion proof standards. The limit of insurance for the candle maker is $500,000. The fire caused $100,000 damage (cost to rebuild) to the building and $200,000 damage to business personal property. The cost to demolish the damaged portion of the building is $30,000. The cost to demolish the remaining structure is $50,000. The cost of rebuilding the ordinance demolished portion of the frame building is $90,000. The additional required cost of rebuilding the entire structure to meet the masonry, wiring, and sprinkler codes is $200,000. Thus, the total amount the insured will need to expend to first demolish and then rebuild the building will be $670,000. The insured is paid for $100,000 fire damage for the building, $200,000 for the fire damaged business personal property, 25% of the paid loss is available for debris removal expense plus $5,000, so the full $30,000 of fire caused debris removal is covered; out of the ordinance caused losses, the full $50,000 ordinance or law policy limit is available. Out of a total of $670,000 insured incurred expenses only $380,000 is paid.

Restrictions and conditions that apply to ordinance or law coverage include: the ordinance must be in effect at the time of the loss; costs associated with reconstruction must be for buildings intended for similar occupancy unless otherwise required by law (can't rebuild as an apartment building if originally a manufacturer unless, by law, the manufacturing facility can't be rebuilt); no coverage for monitoring, cleanup, removal or detoxification of "pollutants" (see COP ADDITIONAL COVERAGES 4 for information on available $25,000 pollution removal coverage); the building or structure must be built within a reasonable period of time after the loss not to exceed two years; "you" will be paid no more than you actually spend if you only partially rebuild or decide not to rebuild, and simply demolish and clear the land for resale or otherwise, or rebuild for similar occupancy, the same size, height and floor area with like kind and quality.

(08/98 Changes: The following is a newly

available endorsement providing optional increased limits.)

The coverage limit for Ordinance or Law can be increased by using endorsement COP-269—Increased Limits Endorsement.

8. PERSONAL EFFECTS

Up to $10,000 coverage at each "covered location" is available for personal effects owned by "you" (as an individual), "your" officers, "your" partners or employees. Personal effects can include clothing, knickknacks, briefcases, plaques and awards, fine arts, personally owned software and valuable papers, gifts for others hidden in office desks, and personally owned furniture. The $10,000 coverage is an aggregate per location coverage, not a per person limit.

(08/98 Changes: The following is a newly

available endorsement providing optional increased limits.)

The coverage limit for Personal Effects can be increased by using endorsement COP-269—Increased Limits Endorsement.

9. PERSONAL PROPERTY—ACQUIRED LOCATIONS

All business personal property, whether existing at the inception of the policy or acquired or manufactured during the policy period is covered by the policy except when the Locations Endorsement—COP-227 and Scheduled Locations Endorsement—COP-226 are added to the policy. When these two endorsements are added, coverage exists only for personal property at scheduled "covered locations." With these two endorsements, there is an additional provision that is activated in the base policy that adds up to $250,000 for business personal property coverage at each newly acquired or constructed building for a period of 90 days, or until the day you report the acquired location to the company, or the end of the policy period, whichever comes first. "You" must pay for the insurance from the date of acquisition or the day construction begins on the property. Coverage is per occurrence, so if you acquire three buildings in one sale, you have up to $250,000 business personal property coverage for each building. No standard COP endorsement exists to increase coverage above $250,000.

10. TREES, SHRUBS AND PLANTS

"Your" lawns, trees, shrubs and plants, including their debris removal, are covered up to $50,000 for any one occurrence caused only by the following: fire, lightning, explosion, riot or civil commotion, falling objects. This is "your" property only and does not include property of others. Falling objects can include falling tree limbs if not caused by weather. Noticeably absent from coverage are the perils of wind, hail, rain, vehicles, animal, chemical or pest damage. To find broadened perils coverage for crops and other plants, consult The Insurance Marketplace, a publication of The Rough Notes Company, Inc.—Possible categories include Hail insurance on growing crops, Multiple peril crop insurance, Golf courses, Horticultural risks.

(08/98 Changes: The following is a newly

available endorsement providing optional increased limits.)

The coverage limit for Trees, Shrubs and Plants can be increased by using endorsement COP-269—Increased Limits Endorsement.

SUPPLEMENTAL MARINE COVERAGES

All of the supplemental marine coverages are not subject to coinsurance if a coinsurance clause (Locations Endorsement COP-227) is added to the policy, and if the Scheduled Locations Endorsement COP-226 is added, then only while property is in or outside of "covered locations," or within 1000 feet thereof. As always, a covered peril must first cause direct physical damage.

1. ACCOUNTS RECEIVABLE

Accounts receivable coverage pays "you" for sums owed you that you cannot collect from your customers after a covered loss. Also covered is the interest "you" must pay the bank if "you" should take a loan against your receivables in order to provide the operating capital necessary for "you" to stay in business. Accounts receivable coverage also pays for any excess expense "you" have beyond what is normal to collect money after a covered loss, and accounts receivable coverage will pay for the costs to reconstruct accounts receivable records including those on paper, disk or tape. The policy base coverage is $50,000. Basic COP policy accounts receivable coverage can be replaced with the Accounts Receivable Coverage Endorsement COP-219 and scheduled with the Scheduled Accounts Receivable Endorsement COP-218. These endorsements do not add to the $50,000 base coverage; they replace the coverage in the policy.

(08/98

Changes: The following is a newly available endorsement providing optional

increased limits.)

The coverage limit for Accounts Receivable can be increased by using endorsement COP-269—Increased Limits Endorsement.

2. FINE ARTS

$50,000 is available for "your" fine arts at "covered locations."

3. PROPERTY ON EXHIBITION

Property on exhibition is for property you have on display at locations "you" do not regularly occupy. Property on exhibition is personal property and the form does not require that the property be owned by "you"; so if you are exhibiting other people's property in addition to your own at a trade show, there is coverage. Coverage is limited to $50,000 for all property on exhibit, regardless of the number of locations where property may be exhibited. An exhibition can include trade shows and flea markets, but does not include property that is in the custody of your salespeople. Examples of covered property are the trade booth, including electronics, wiring and associated equipment, but not stock if it is held for sale or in the custody of anyone acting in the capacity as a sales representative.

(08/98 Changes: The following is a newly

available endorsement providing optional increased limits.)

The coverage limit for Property on Exhibition can be increased by using endorsement COP-269—Increased Limits Endorsement.

4. PROPERTY IN TRANSIT

Up to $50,000 coverage is available for property in transit. This is a per occurrence limit and includes business personal property except property in the custody of sales representatives. Occurrence as defined includes all vehicles, trailers, conveyances involved in the same occurrence. If three trailers are involved in the same accident, only $50,000 coverage is available. Coverage is for owned and nonowned personal property. (Note: under property of others #11 in PROPERTY NOT COVERED, if you are a carrier for hire, or are acting as a backhauler, then property of others is not covered.)

(08/98 Changes: The following is a newly

available endorsement providing optional increased limits.)

The coverage limit for Property in Transit can be increased by using endorsement COP-269—Increased Limits Endorsement.

5. SALES REPRESENTATIVE SAMPLES

Sales representative samples ("yours" and sample property belonging to others while in your custody) are covered up to $50,000 while in the custody of salespeople, in transit between "covered locations" and the sales representative, and in "your" (as an individual, officer, partner or employee) custody while "you" are acting in the capacity of a sales representative. This includes property you have as samples for sale at exhibition. Sales representative samples do not include the property "you" have for sale at "your" retail locations.

(08/98 Changes: The following is a newly

available endorsement providing optional increased limits.)

The coverage limit for Sales Representative Samples can be increased by using endorsement COP-269—Increased Limits Endorsement.

6. VALUABLE PAPERS AND RECORDS—COST OF RESEARCH

Up to $50,000 "Valuable papers and records" cost of research coverage is available. Paper, disk, tape, magnetic, or electronic media valuable papers are covered for the cost of research necessary to reproduce, replace or restore lost or damaged information. Coverage exists whether or not there are duplicate copies of damaged media. Duplicate coverage for accounts receivable records cost of research does not exist here.

Coverage example: The architectural firm had a major fire. Many of the latter drawings were on CAD-CAM and duplicate records did exist. These records were reinstalled on new equipment purchased to replace the damaged work stations. Approximately 100 hours of work @ $25 per hour was required to reinstall the disks and touch up drawings that had not been included in the most recent back-up tapes. However, over 300 hours of legwork and $3,000 of duplication expense was required by the architects who had to search through customer records to retrieve and duplicate plans and drawings for current projects, and for completed products where a need to maintain plans still existed. Total payroll cost @ $25 per hour was $10,000 plus the $3,000 of duplication expense made the total covered pay out—$13,000.

(08/98 Changes: The following is a newly

available endorsement providing optional increased limits.)

The coverage limit for Valuable Papers and Records—Cost of Research can be increased by using endorsement COP-269—Increased Limits Endorsement.

PERILS COVERED

The COP policy covers for external risks of direct physical loss caused by a peril that is not excluded. Therefore, the company must prove after a loss that an excluded peril caused the loss. If the company cannot, coverage exists. The term external risk requires outside forces to act upon the item. Spontaneous combustion would not be covered. Direct physical loss does not include loss of use or the loss in perceived value of goods in the marketplace after an otherwise insured peril—i.e.: a new model of the small plane you manufacture catches fire in midair during a test flight and crashes. Though the aircraft is given certification by the FAA, leery potential customers decide not to purchase your product. The damage to the crashed plane is covered, but the resulting loss of income and perceived loss of value are not paid by the COP policy.

PERILS EXCLUDED

1. The doctrine of "concurrent causation" holds that an "all risk" policy must pay if a loss to property is attributable to two causes, one excluded by the policy and one covered. By application of this concept, coverage has been found for earth movement, flood and other specifically excluded events. The COP policy, in an effort to avoid concurrent causation, says that if one or more excluded peril causes the loss, regardless of any other causes that contribute or aggravate the loss (even if the contributing cause of loss is normally covered), then there is no coverage. An example might be an earthquake that first damages a building's wall but a tree limb falls during the tremor, knocking down a portion of the roof. Falling objects are normally covered, but because the tree limb's fall was as a result of the earthquake, neither event is covered.

1a. ORDINANCE OR LAW

Any increased cost caused by the enforcement of any building code or law is not covered except to the extent it is covered under the Supplemental Coverages ($50,000 basic coverage, can be increased by endorsement).

1b. EARTH MOVEMENT OR VOLCANIC ERUPTION

The perils of earthquake, landslide, mud slide, mine subsidence, sinking-rising-shifting earth, or if earth movement is caused by volcanic eruption-explosion or effusion are excluded for all property except "computers," "mobile equipment" and the Supplemental Marine coverages (accounts receivable, fine arts, property on exhibition, property in transit, sales representative samples, valuable papers and records-cost of research). "Sinkhole collapse" is covered as well as any direct loss from fire or explosion that is a direct result of any otherwise excluded earth movement peril or volcanic eruption. Volcanic eruptions that occur during a 168 hour period will be considered one event.

Example of fire: The building was damaged by earthquake, cracking walls and collapsing shelving. The shifting of the earth caused a gas main to rupture and the resulting fire burned the building to the ground. Damage attributed to the earthquake was estimated at $200,000, while the total loss was estimated at $1,000,000. In adjusting the loss, the company will deduct the $200,000 earthquake damage and pay the remaining $800,000 fire loss.

The Earthquake Endorsement COP-221 can add earthquake coverage.

1c. CIVIL AUTHORITY

Acts of civil authority to prevent the spread of fire (not a fire caused by an excluded peril) is covered. I.E.: "Your" garage is burned to the ground to act as a fire break against an advancing forest fire to prevent the fire from reaching your manufacturing plant. Other acts of civil authority—seizure, confiscation, destruction or quarantine of property—are not covered. Seizure and confiscation generally have to do with illegal activities; destruction normally involves tainted foods; and quarantine involves living organisms (plants, animals, lab viruses and bacteria). No standard COP endorsement exists to provide coverage.

1d. NUCLEAR HAZARD

Virtually all causes of nuclear damage are excluded. However, direct loss by fire as a result of any nuclear mishap will be covered. The example used in the earthquake exclusion will also apply here. Coverage for nuclear risk can only be purchased through nuclear umbrella coverage associations.

1e. UTILITY FAILURE

Brownouts, power surges, power station breakdown or other utility failures or inconsistent power delivery are excluded causes of loss. However, direct loss by fire at any "covered locations" as a result of any power interruption will be covered. The example used in the earthquake exclusion will also apply here. Coverage for various types of utility interruption is available through the Utility Interruption Property Damage Endorsement—COP-244 and Utility Interruption, Property Damage—Separate Limits—COP 267.

(08/98 Changes: COP 267 is a newly available endorsement providing optional increased limits.)

1f. WAR

War, declared, undeclared, warlike action, destruction or seizure or use of the property for military purposes, and any (even accidental) discharge of a nuclear weapon is excluded.

No standard COP endorsement is available to provide coverage.

1g. WATER

Flood, surface water, waves, tidal water, overflow of a body of water whether wind driven or not is excluded. Back-up of sewers and drains, and ground water that exerts pressure through walls, sidewalks, foundations, driveways, swimming pools or other structures is excluded. Examples of excluded ground water losses: frost heaves, excess rain seeping into and flooding a basement, cracking of a swimming pool by the pressure of frost. Resulting damage from fire, explosion or sprinkler leakage is covered. This exclusion applies to all property except "computers," "mobile equipment" and the Supplemental Marine coverages (accounts receivable, fine arts, property on exhibition, property in transit, sales representative samples, valuable papers and records-cost of research).

Additional property can be covered for flood using the Flood Endorsement—COP-223.

2a. ANIMALS

Animal, bird, insect or vermin damage is excluded for all causes of loss except by the "specified perils" or breakage of building glass. Nesting damage, excretions, termite infestation, consumption or contamination of food or grain are all examples of excluded animal damage. A deer crashing through a glass window causing damage to the window is an example where coverage would apply. If the deer that crashed through the window was to create additional damage such as trampling goods and knocking down shelves, the resulting damage would only be covered if caused by a resulting "specified peril" such as falling objects caused by the deer rampage. No standard COP endorsement exists to add coverage.

2b. COLLAPSE

Collapse is later defined under OTHER COVERAGES, 1. Collapse. All other incidents of collapse are excluded for all covered property except "computers," "mobile equipment" and the Supplemental Marine coverages (accounts receivable, fine arts, property on exhibition, property in transit, sales representative samples, valuable papers and records, cost of research). Resulting loss caused by a covered peril is covered; i.e.: the excluded cause of collapse knocks over a Bunsen burner and causes a fire in the laboratory.

2c. CONTAMINATION OR DETERIORATION

Corrosion, decay, fungus, mildew, rot, rust or any fault or weakness or inherent weakness in covered property that cause it to damage or destroy itself is excluded. For example, paint in cans will harden over time, other goods fade when exposed to sun, and iron objects will rust when exposed to moisture.

Coverage is provided for corrosion, decay, fungus, mildew, mold, rot or rust to "computers" as a result of direct physical loss by an otherwise covered peril to the air conditioning system that services "your" computers.

No standard COP endorsement exists to extend this coverage to other property.

2d. CRIMINAL, FRAUDULENT OR DISHONEST ACTS

Criminal, fraudulent or dishonest acts, whether done alone or in collusion with others, by "you" to others who have interest in "your" property, to whom "you" entrust property, "your" partners, officers, directors, trustees, joint adventurers or any of their employees are excluded. Destruction or malicious damage by "your" employees is covered, but not theft; i.e.: coverage is available when disgruntled strikers break windows at your plant, but not to the two employees who break in and rob the safe of money, securities and other property.

This exclusion does not apply to covered property while in the custody of a carrier for hire; i.e.: if your shipment is stolen by freight forwarding employees involved in a hijacking, you are covered.

Coverage for employee dishonesty is available using COP-255. (ISO employee dishonesty forms and endorsements may provide broader, or more appropriate coverages than the COP-255.)

2e. DEFECTS, ERRORS AND OMISSIONS

Defects, errors and omissions include those associated with land use, design, specification, construction, installation, or maintenance of property or planning; zoning, development, siting, surveying, grading, compaction or property maintenance; defect, weakness, inadequacy, fault or unsoundness of materials used in construction; the cost to make good any errors in design, data processing or programming errors; improper instructions. Also excluded are deficiencies in design, specifications, materials or workmanship or latent defect to business personal property.

Examples

of excluded situations:

(1) Property built upon wetlands is torn down.

(2) Inadequate roof supports cause the roof to bow.

(3) A weld in the conveyor system is weak and cracks—sending twenty newly manufactured computers crashing to the floor.

Coverage for errors in design of property built for or sold to others can usually be found in professional liability coverages. Coverage for other latent defects and the tendency of goods to self-destruct is not available under any standard COP endorsement.

2f. ELECTRICAL CURRENTS

Electrical arcing and other damage by artificially generated electrical currents is excluded. Damage by any resulting fire as well as natural lightning is covered. Other natural electrical damage, such as static electricity, is not covered. Like the utility interruption exclusion, if power interruption causes another covered cause of loss, the resulting damage is covered. Arcing causes an explosion, the damage resulting from the explosion is covered, but not the damage caused by the arcing itself.

Endorsement COP-265—Additional Computer Coverages, can be added to provide coverage for damage to computers by electrical disturbance and power surges.

(08/98 Changes: The following are newly available endorsements

providing optional enhanced coverage.)

Equipment Breakdown Coverage can be added via endorsement COP-103. Computer Coverage Equipment Breakdown can be added using COP-274.

2g. EXPLOSION

Explosions of steam boilers, steam pipes, steam turbines, or steam engines are excluded unless caused by the explosion of gas or fuel in a firebox, combustion chamber or flue. Resulting fire damage is covered.

Examples

of coverage:

(1) The boiler explodes because an improper fuel mixture causes gas to accumulate beyond the capability of the boiler to contain the combustion.

(2) The boiler overheats and bursts into flames. Damage to the cracked boiler is excluded, but damage caused by the ensuing fire is covered.

Examples where coverage does not exist: steam pipe bursts, ruining thousands of dollars of inventory; the boiler runs out of water and cracks and explodes, damaging the boiler room walls.

(08/98 Changes: The following are newly

available endorsements providing optional enhanced coverage.)

Equipment Breakdown Coverage can be added via endorsement COP-103. Computer Coverage Equipment Breakdown can be added using COP-274.

2h. FREEZING

Loss caused by frozen plumbing, heating, air conditioning and other appliances from water, liquids, powders and molten materials are not covered unless reasonable care has been taken by "you" to maintain heat in a building or structure or "you" drain the equipment and turn off the supply if the heat is not maintained. This exclusion does not apply to fire protective systems that discharge in freezing conditions. There is no standard COP endorsement to add back this coverage. (See also OTHER CONDITIONS 15. Vacancy and Unoccupancy for an expanded water damage exclusion for property vacant or unoccupied for 60 days or more).

Exclusion examples: (1) You don't pay the bills and gas is shut off and pipes freeze. When they thaw, they flood the showroom floor. (2) Your tenant turns off the gas when leaving for vacation. Pipes burst and ruin the rental dwelling's carpet and flooring.

Coverage example: Vandals break basement windows Friday night in your building. A blizzard's wind knocks out the heating system pilot light and, as a result of the vandalism, the pipes freeze and then burst when they thaw.

2i. INCREASED HAZARD

Losses that occur when the hazard has been materially increased within "your" knowledge or control are excluded. This is a difficult exclusion for any adjuster. First, there is no standard definition for material increase, and the concept of hazard is different for every industry. The intent of this exclusion is to prevent the insured from grossly altering its business process without notifying the company. A retail grocery store that decides to open a fireworks factory in the back room would be an exaggerated example of material increase in hazard. Would storing a 5 gallon can of gasoline inside the building to supply the newly purchased lawn mowing equipment be a material increase? Would the addition of a Fryolator to a restaurant that only had baking ovens be a material increase? Some businesses will try anything that helps them earn money. It is these businesses that the agent and underwriter will have to carefully watch during the course of the policy period to make sure that all activities are understood and properly documented.

No standard COP endorsement is available to counteract this exclusion. If an insured should venture into businesses or processes beyond what the insurance company and underwriter originally contemplated, documents recording an agreement by the company to insure should be drawn up and, where possible, added to the policy through a manuscript endorsement.

2j. LOSS OF USE

Business income coverages are excluded, but are available by endorsements—Income Coverage Part—COP-101, and Extra Expense Coverage COP-102.

2k. MECHANICAL BREAKDOWN

The mechanical breakdown or rupturing or bursting by centrifugal force of any object other than "computers” is excluded. No standard COP endorsement exists to provide expanded mechanical breakdown coverage.

(08/98 Changes: The following are newly

available endorsements providing optional enhanced coverage.)

Equipment Breakdown Coverage can be added via endorsement COP-103. Computer Coverage Equipment Breakdown can be added using COP-274.

Exclusion examples:

(1) A punch press requiring 440 current loses 1/4 of its electrical phase and releases the cycle prematurely onto a customer's die, damaging it and warping the punch press.

(2) The lack of lubrication causes an engine to seize up.

(3) The governor breaks on a machine, the engine overrevs and the flywheel bursts, damaging both the machine and surrounding walls and windows.

Coverage example: A computer controlled machine's program locks up, damaging both product and machine.

2l. NEGLECT

During and after the loss occurs, "you" must use all reasonable means to protect the property from further damage. Subsequent damage after neglecting to preserve the property from damage is excluded. No standard COP endorsement is available to provide coverage.

Exclusion examples:

(1) Instead of attempting to use an available fire extinguisher to dampen a wastebasket fire, "you" wait until the fire department arrives. The fire damage to the wastebasket would be covered, but not the damage to the rest of the property.

(2) A tree limb falls upon the roof and opens a hole. Rather than repair the damage, "you" wait until the adjuster arrives the next day. Between the limb falling and the adjuster's arrival, a rainstorm sends a torrent of water through the hole in the roof, damaging walls, flooring and ruining hundreds of reams of special paper stock. The damage caused by the tree falling is covered, but any damage from the resulting rain is excluded.

2m. POLLUTANTS

Loss caused by the release or migration of "pollutants" is excluded unless the escape is caused by a "specified peril" and the resulting damage is by that "specified peril. Under ADDITIONAL COVERAGES 4, "pollutant" cleanup and removal, there is $25,000 coverage available for pollution cleanup.

Coverage examples:

(1) Fire causes the burning of transformers containing PCB's and the PCB contamination requires the destruction of the entire building and contents.

(2) Accidental sprinkler leakage fills an open tank of chemicals that eventually spills over, damaging flooring.

(08/98 Changes: The following is a newly

available endorsement providing optional increased limits.)

The coverage limit for Pollutant Cleanup and Removal can be increased by using endorsement COP-269—Increased Limits Endorsement.

2n. SEEPAGE